As the COVID-19 pandemic wears on in the United States, the hardest-hit segment is likely to be commercial solar — projects built on businesses, schools and government buildings.

Compared to its pre-pandemic projections, Wood Mackenzie is forecasting a 32 percent drop in commercial solar installations in 2020. Commercial businesses — hugely impacted by current economic conditions — will likely opt out of discretionary investments such as installing solar this year.

But what’s the true potential of this market in the post-2020 period? Wood Mackenzie and Station A, an AI-enabled clean energy marketplace, collaborated on a first-of-its-kind analysis to find out.

Quantifying the untapped potential

Historically, measuring commercial solar potential has been challenging due to a lack of reliable data. By combining Wood Mackenzie’s project-level solar data with Station A’s building-level data*, WoodMac was able to get an accurate bottom-up view of this market for the very first time.

The key findings won’t surprise anyone in the commercial solar industry: There is massive market potential.

About 3.5 percent of all commercial buildings have solar and another 1 percent are attached to community solar subscriptions, where customers buy power from a solar project located in the same utility territory.

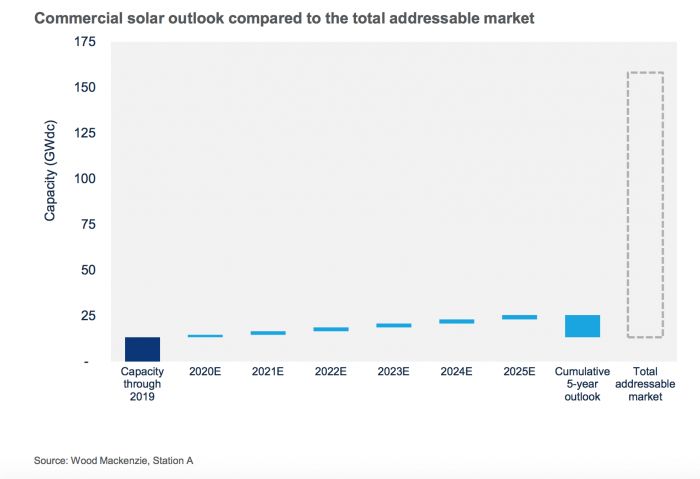

Not all buildings spend enough money on electricity to make solar a worthwhile investment. Once you account for those buildings — roughly 25 percent of the building stock — you’re left with approximately 70 percent of the commercial buildings as potential targets for solar installers. That equates to more than 600,000 sites and 145 gigawatts of solar capacity potential.

Why isn’t commercial solar growing more rapidly?

Wood Mackenzie’s outlook has the commercial solar market growing at roughly 2 gigawatts a year from 2021-2025, bringing the installed total to around 8 percent of the total addressable market.

But despite the enormous market potential, major challenges remain. Unlike residential solar that has standardized financing or utility-scale solar that has the benefit of scale, commercial solar has neither.

Each commercial solar project has a high degree of customization and complexity. The work and expense involved in acquiring a customer and obtaining financing can frequently kill deals. And the pandemic may temporarily exacerbate these problems by causing financiers to be more conservative.

These are tough challenges that depend on numerous financial and regulatory factors. And there’s a slew of innovative companies working hard to solve these problems. If they can be overcome, a massive addressable market awaits.

***

The new commercial solar market analysis with Wood Mackenzie and Station A is available here. Michelle Davis is a senior solar analyst at Wood Mackenzie.

*Station A’s AI-enabled platform includes the majority of commercial buildings in the U.S. that have at least 10,000 square feet of roof space, roughly the equivalent of a 70-kilowatt solar project.