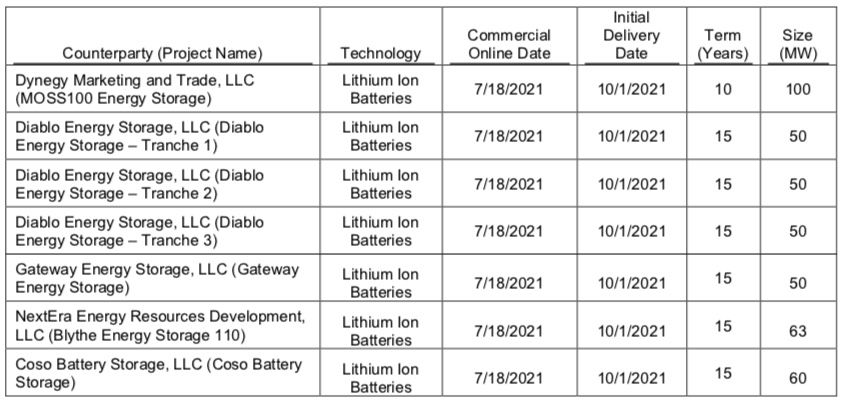

Pacific Gas & Electric has asked California regulators to approve seven battery projects totaling 423 megawatts, or nearly 1.7 gigawatt-hours of energy storage capacity, to meet its share of a statewide procurement that must be brought online by late next year to assure statewide grid stability.

PG&E’s 2020 System Reliability Request for Offers, filed Monday with the California Public Utilities Commission, represents a huge new addition to the utility's battery fleet to meet the state’s resource adequacy needs starting in 2021. It’s the second major procurement from a California utility designed to comply with the CPUC’s order for 3.3 gigawatts of carbon-free resources to help meet grid reliability needs that will arise when four natural-gas-fired power plants retire next year to reduce their environmental harm to coastal waters.

PG&E’s portfolio of new battery projects isn’t the biggest one meant to make up for those power plants, whose retirement has already been delayed by a year to allow clean energy replacement resources to be brought online. Earlier this month, utility Southern California Edison announced 770 megawatts, or nearly 3 gigawatt-hours, of storage from seven winning bids, most of them connected to existing solar farms. SCE has the largest share of procurement since it faces the more severe potential grid disruptions from closing the power plants.

But PG&E’s new proposal does represent a major boost to a battery fleet that’s already set to be the largest in the world. PG&E’s major projects include a 300-megawatt/1,200-megawatt-hour project by Vistra Energy and a 182.5-megawatt/730-megawatt-hour project from Tesla being built near a natural-gas plant in the Monterey County community of Moss Landing.

PG&E is now adding another 100 megawatts/400 megawatt-hours of battery plant from Vistra to be part of its new resource adequacy portfolio in the transmission-constrained South Bay/Moss Landing sub-area. It’s also adding three 50-megawatt/200-megawatt-hour systems to the existing 50-megawatt Diablo Energy Storage project being built by LS Power in Contra Costa County.

First geothermal plant connected to a grid battery

Several of PG&E’s projects lie outside its service territory. Those include a 50-megawatt/200-megawatt-hour system to be built by LS Power at its Gateway site in San Diego County, which is planned to contain up to 250 megawatts of energy storage when complete, and a 63-megawatt/252-megawatt-hour system to be built by NextEra Energy Resources at its Blythe solar farm in Riverside County. The latter is the only project on PG&E’s list that will be co-located with a solar farm, in contrast to SCE’s preponderance of solar-connected systems.

PG&E is, however, planning a battery system connected to a geothermal plant in Inyo County. The 60-megawatt/240-megawatt-hour project will be built by Coso Battery Storage, a wholly owned subsidiary of CGP Holdings, which is contracting its operation to developer Middle River Power.

This is the first energy storage project on record to be connected to a geothermal plant, Daniel Finn-Foley, head of energy storage for Wood Mackenzie Power & Renewables, said in a Tuesday email. But given that “co-location with existing plants is a key method of saving time and costs on interconnection, it's only natural we will see storage married to a more diverse range of resources” beyond the growing ranks of solar- and wind-interconnected battery projects being built around the world, he added.

PG&E’s new round of contracts, which must still be approved by the CPUC, is the third major storage deal to be announced just this month, including SCE’s projects and another nearly 3-gigawatt-hour procurement announced by Hawaiian Electric last week.

PG&E picked the winning projects from 23 unique offers from 12 different parties, including demand response and existing natural-gas-fired power plants. Its final portfolio actually exceeds the 383 megawatts it needed to procure and put into service by late 2021 under the CPUC’s order, which asked the state’s utilities and community-choice aggregators to bring half of the 3.3-gigawatt total online by August 2021.

PG&E, which is seeking to emerge this summer from a bankruptcy caused by tens of billions of dollars of liabilities for wildfires caused by its equipment, will have a tight deadline to complete these projects. The California Energy Storage Association and storage companies have asked the CPUC to expedite the process for reviewing and approving projects under deadline, warning that COVID-19-related supply and economic disruptions might otherwise make it challenging for developers to secure financing for them.

Massive battery farms are expected to become an increasingly central asset for California’s grid as the state pushes toward its goal of getting 100 percent of its energy from carbon-free resources by 2045. The state’s 2013 mandate to bring 1.35 gigawatts of energy storage online by 2020 is already being eclipsed, as utilities and regulators seek storage to better integrate its rising share of intermittent solar and wind power into a power grid that’s losing key baseload resources, such as PG&E’s Diablo Canyon nuclear power plant set to close in 2025, and could see its natural-gas power plant fleet forced to retire to meet its zero-carbon goals.