Xcel Energy CEO Ben Fowke observed earlier this year that time is running out for coal-fired power plants in the U.S.

“I will tell you, it's not a matter of if we're going to retire our coal fleet in this nation, it's just a matter of when,” Fowke said on stage at the EEI Annual Convention in San Diego in June.

For the Public Service Company of Colorado (PSCo), an Xcel Energy subsidiary, that time is now.

On Monday, the utility won preliminary approval for its coal plant retirement plan. The Colorado Public Utilities Commission voted unanimously to allow for the early closure of coal-fired units 1 and 2 at Xcel’s Comanche Generating Station in Pueblo County. The units are capable of producing a combined 660 megawatts of coal-fired generation, which represents approximately one-third of PSCo’s remaining coal fleet.

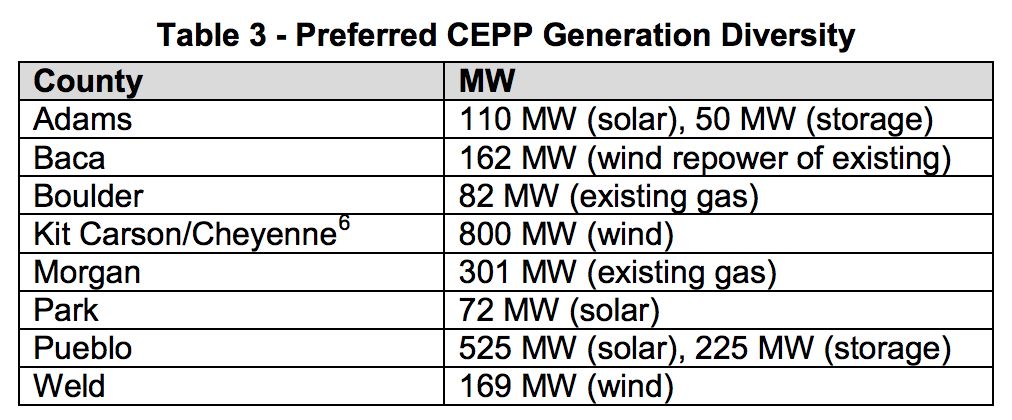

Under Xcel’s Colorado Clean Energy Plan (CEP), the Comanche coal units will be replaced with a $2.5 billion investment in renewables and battery storage — including of 1,131 megawatts of wind, 707 megawatts of solar PV, and 275 megawatts of battery storage across the state, including in Pueblo. Xcel estimates the transition will save ratepayers between $213 million and $374 million.

The decision comes as Xcel is attracting record-low clean energy prices. In January, the results of Xcel’s all-source solicitation returned a median price bid of $21 per megawatt-hour for wind-plus-storage projects and a median bid of $36 per megawatt-hour for solar-plus-storage.

Bids highlighted in the CEP are even lower. The plan includes wind at pricing of $11 to $18 per megawatt-hour, solar at $23 to $27 per megawatt-hour, and solar-plus-storage at $30 to $32 per megawatt-hour.

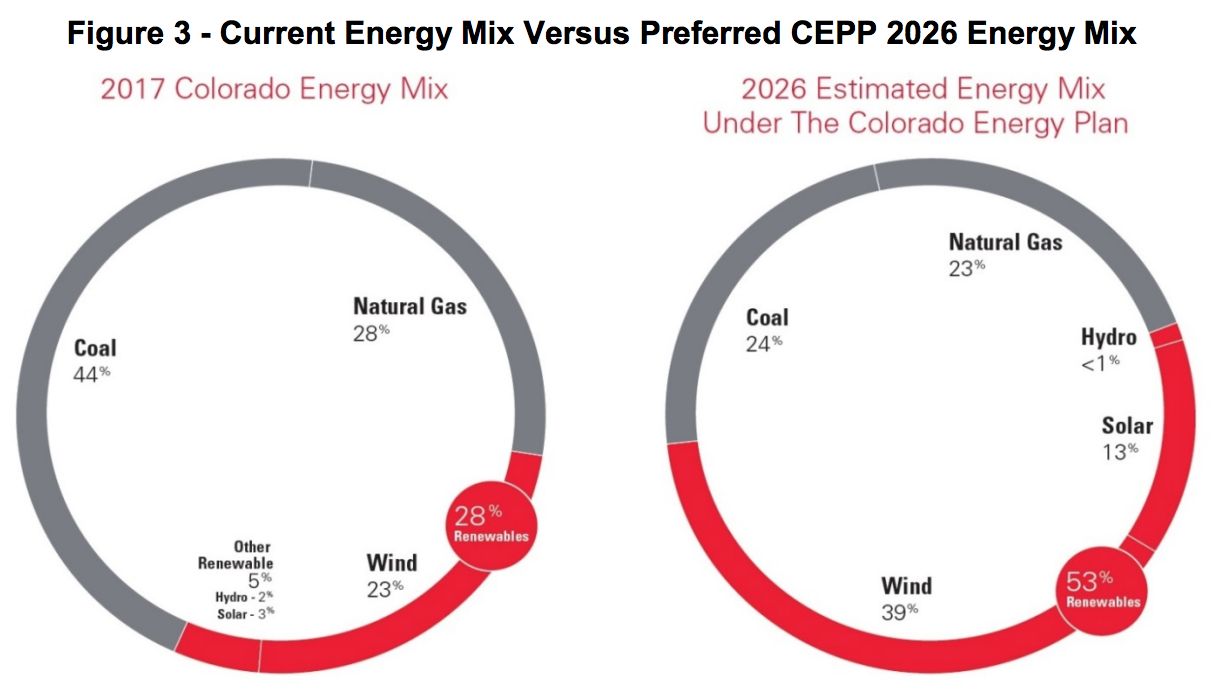

By 2026, the CEP will bring PSCo’s energy mix to nearly 55 percent renewable energy, up from 28 percent in 2017. Coal made up 44 percent of Colorado's electric generation last year, which would decrease to about 24 percent under the plan. Natural gas will remain roughly the same.

By the same year, the utility estimates its carbon emissions will be approximately 60 percent less than in 2005, and that its nitrogen oxides and sulfur dioxide emissions could be about 90 percent lower than in 2005. These reductions surpass the goals Governor John Hickenlooper set forth in a 2017 executive order on supporting Colorado’s clean energy transition.

The Colorado PUC must now formalize its support for the CEP in a written decision, which is due by September 4.

“While we’re still awaiting the final written decision…the plan is a clear rebuttal to the notion that we have to choose between affordable electricity rates and clean air,” said Zach Pierce, senior campaign representative for Sierra Club’s Beyond Coal campaign in Colorado. “The Colorado Energy Plan should stand as an example to all utilities in the region still relying on costly, polluting coal plants to examine how they can benefit from switching to clean energy too."

The case for greater resource diversity

Xcel Energy made a strong case for ambitious action in its latest electric resource plan, which laid out the Colorado Clean Energy Plan as well as several less ambitious alternatives.

Not all of the clean energy projects pitched in the CEP are needed by the system at present, Xcel noted. However, the utility argued that these projects offer immediate economic and environmental benefits, because PSCo will be able to take full advantage of federal tax credits for wind and solar projects before they expire, allowing the utility to deploy a greater amount of renewable energy resources than it could justify otherwise.

Customers stand to benefit from this directly. Diversifying PSCo’s fuel mix serves as a customer protection “by acting as a natural hedge against commodity prices,” the proposal states. The combination of renewables, battery storage and existing gas assets also offers, “increased operational flexibility and reliability,” according to the utility — which contradicts statements the Trump administration has made in defense of subsidizing coal and nuclear power plants.

“Adding geographic diversity to the system not only supports reliability, but it also benefits the state of Colorado through dispersed investments supporting the economic vitality of communities in numerous regions,” Xcel’s proposal continues.

According to Western Resource Advocates, which led the advocacy effort around the plan, the CEP will create 500 jobs in the first five years, generating an additional $44 million in local gross domestic product over the same period, and an average of $10 million from 2018 to 2040.

The plan makes a point of investing heavily in Pueblo County, which has served as the host community for the Comanche coal units since the 1970s. It calls for 525 megawatts of new solar projects with 225 megawatts of battery storage, as well as a new transmission switching station all within the region. These investments are expected to create a net benefit for the county’s tax base and help to position Pueblo as an emerging renewable energy hub.

With approval of the CEP secured, the Sierra Club argues that Xcel is also positioned to move forward with a 240-megawatt solar project in Pueblo to provide power to EVRAZ Rocky Mountain Steel, Xcel’s largest private customer in Colorado. EVRAZ and Xcel agreed to a 22-year contract will enables steel manufacturer to invest $500 million to expand operations in Pueblo.

In the CEP proposal, Xcel called for investing an additional $204 million in transmission across the state and for allowing both utility and third-party ownership of new renewable energy resources — at the request of the PUC. These elements are expected to be in the approved plan, although specific components still remain unclear as regulators finalize their decision.

--

Jonathan Adelman, Area Vice President for Strategic Resource & Business Planning, Xcel Energy, will be speaking at GTM’s Power & Renewables Summit, taking place in Austin on November 13-14. Jonathan will be joining other senior executives from key power market players, including Exelon, ERCOT, First Solar, Arizona Public Service, Los Angeles Department of Water & Power, CPS Energy, and many more. Meet them to understand how decarbonization and sector electrification will reshape the power markets of the future. Learn more here.