In Texas, the firm Enchanted Rock has quietly been providing distributed generation systems to water utilities and large commercial clients for years. The company is now scaling up with a new natural-gas-based microgrid system that it hopes will put it on the national map as a microgrid provider.

ERock recently received an undisclosed equity financing from Balfour Beatty Infrastructure Partners to form a new entity, Texas Microgrid, which will provide microgrids-as-a-service to commercial and industrial customers.

Texas Microgrid will use the financing to build more than 50 megawatts of microgrids at approximately 45 sites in the greater Houston area using ERock’s fifth-generation microgrid technology, which uses natural gas generators as the core generation source. Until now, ERock has used diesel generation as the backbone for its microgrids, which have mostly been used as components of larger installations.

“We’re offering reliability and services not just to some people who have to have it -- like water treatment facilities -- but for those that would like to have it and have a reputational risk,” said Thomas McAndrew, founding partner and managing director of ERock.

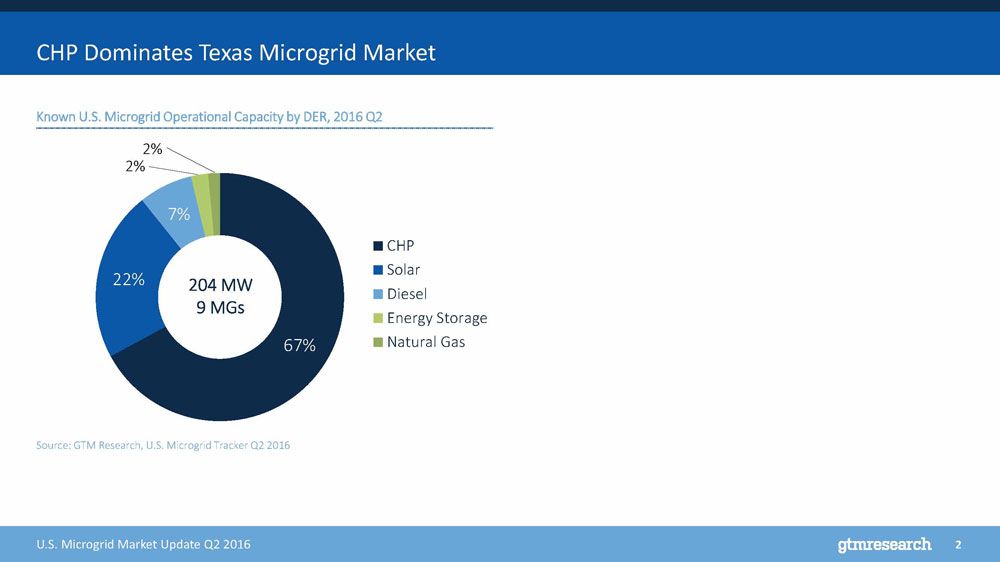

In Texas, natural-gas-based combined heat and power systems are dominant in the microgrid market. Texas is second only to New York in terms of installed microgrid capacity, according to GTM Research's most recent microgrid market update. Yet most of the state's capacity is made up of just a few large projects. More than half of Texas’ 204 megawatts of operational microgrid capacity is in the University of Texas’ 137-megawatt microgrid, according to Omar Saadeh, senior analyst with GTM Research.

But the appeal of commercial and industrial microgrids is growing, said Saadeh, both in Texas and nationally. Some utilities, like Southern Company, have acquired microgrid providers, while others like Arizona Public Service are partnering with firms to serve the behind-the-meter microgrid market.

“Financing a microgrid development often requires complex and time-consuming financing solutions,” said Saadeh. “For a customer segment with shorter time horizons when compared to more traditional adopters such as universities or the military, reducing the capex burden is key.”

Sea, space and ERCOT

Texas Microgrid aims to simplify the building and financing process by standardizing the microgrid components and installation and providing a simple one-time upfront payment that allows the remainder of the cost to be paid back through energy markets.

McAndrew and his co-founder Clark Thompson have a unique blend of engineering and energy market backgrounds that give them a deep understanding of how to leverage a microgrid for profit in energy markets while meeting customer power needs.

After designing a few microgrids starting in 2010 for water utilities, ERock raised a round of funding to develop 176 megawatts of microgrids. The microgrids can operate seamlessly with the grid or in islanded mode. The 19 microgrids are mostly diesel-based.

McAndrew, who began his career working with nuclear-powered naval ships, brings together generators that his engineering team has developed using off-the-shelf components that are networked together with other assets on the microgrid using proprietary software systems. McAndrew leverages his experience with ships, “which are essentially microgrids,” and also his experience in energy trading. He has worked at both Enron and Calpine.

Co-founder Thompson worked as an aerospace engineer for a firm serving Boeing, NASA and others by building systems that can survive in the ultimate island mode: in outer space.

The focus on reliability and resiliency for specific high-power applications is why they have not worked with natural gas until now. “We’ve been looking at natural gas as long as the company has existed,” said McAndrew. “Natural gas engines had not been very reliable when it comes to what our customers demand.”

Those demands often include large power draws for motors, and it wasn’t until recently that natural gas generator manufacturers have provided the reserve torque that many of their customers required, said McAndrew. Reliability is not just about power when the grid is down, but also about meeting specific power needs during regular operation.

Texas Microgrid offers its natural-gas gensets for customers, and then adds in other assets customers may want to integrate into the microgrid such as solar, storage or already existing onsite backup systems. “We see solar as a range extender,” added McAndrew.

As for natural-gas-based combined heat and power systems, a popular choice for microgrids in Texas and other states such as New York, McAndrew said the engineering required makes these projects too expensive. “CHP is always custom,” he said. “It’s one of the reasons we stay away from it.”

From signing a contract to getting up and running takes less than a year for smaller projects, and sometimes even as little as four months. Much of that time is for permitting and interconnection. The actual construction of a small microgrid, about 1 megawatt in size, can be as fast as two weeks.

Customers pay a “small upfront fee,” said Robert Cauthen, COO of ERock, and then the remainder of the cost and a return on the investment is earned through various ERCOT markets. Texas Microgrid will own and operate the system for the length of the deal, typically 10 to 15 years.

“We’re opening up a whole new segment that can now get this at a very reasonable cost,” said Cauthen, including grocery stores, hospitals and food processing plants.

The microgrids can be bid into ERCOT individually or in aggregate, depending on whatever makes the most sense at the network level and given the requirements of each site. Managing the final cost of the system is critical to making the economics work, said McAndrew.

When it comes to microgrids for the commercial and industrial sector, there are various financing solutions. In Southern Company’s PowerSecure program, which manages about 1,500 megawatts, many customers own or finance their own projects. Energy service providers are also jumping into the market, including GE’s Current and Constellation.

“We’ve noticed a recent uptick in energy service providers, including deregulated utility businesses, looking to leverage in-house technical expertise and project experience to aggressively target the C&I market. Some of these players, such as Exelon, have larger ambitions to go beyond the meter and develop distribution grid microgrids,” said Saadeh. Tangent Energy, another distributed energy competitor, manages more than 600 megawatts and turns behind-the-meter assets and backup generators into energy market assets.

But Texas Microgrid feels it has an advantage over some other solar-plus-storage or backup generator companies because its systems are truly microgrids that can operate in sync with the grid or in islanded mode, rather than just acting as a collection of behind-the-meter distributed assets that may or may not operate as a true microgrid.

The company says it has a pipeline far larger than the initial 50 megawatts and expects to move into other wholesale energy markets beyond Texas in the next year.