Longi Solar, JinkoSolar and REC Group appear to have emerged victorious from a legal attempt to shut the manufacturers out of the U.S. market.

In a complaint filed in March, Hanwha Q Cells alleged that all three companies were infringing on a patent filed in 2008 by importing cells and modules that used proprietary technology.

The case is now stayed, with a judgment of non-infringement expected within the next two weeks, according to a late Tuesday filing from the U.S. International Trade Commission. The determination applies to all three of the companies named in Hanwha’s complaint.

In a statement on the decision, JinkoSolar said the decision affirms its position that Hanwha’s allegations were “without technical or legal merit.” REC and Longi did not immediately respond to requests for comment on the decision.

Though the U.S. International Trade Commission has yet to release its determination, the court wrapped up deliberations long before it was expected to do so. A hearing on the case was slated to start November 22, with a legal timeline stretching into 2020.

Hanwha does have a few avenues to challenge the adverse outcome. The South Korea-based manufacturer can appeal to U.S. ITC commissioners for a review of the decision, which was made by an administrative law judge assigned to the case. The company said in an emailed statement that it plans to "immediately appeal" the determination to commissioners once they are released. Hanwha maintained its position that REC, Jinko and Longi are infringing on the patent.

If the outcome remains unchanged after that appeal, Hanwha can also appeal to the U.S. Court of Appeals for the Federal Circuit. But reversing the decision may be a long shot, according to John Smirnow, general counsel and vice president of market strategy at the Solar Energy Industries Association.

“It would be a significant uphill battle for Hanwha to get this reversed,” said Smirnow. “At this stage, the judge is basically saying, ‘I’ve seen all the evidence and based on everything I know today, these companies are not infringing on Hanwha’s patent.’”

SEIA, along with several solar developers, argued in public comments on the case that a positive outcome for Hanwha would damage the solar industry by locking out suppliers at an essential time for the U.S. industry.

Wood Mackenzie Power & Renewables expects the U.S. market to remain in undersupply through Q4 for monocrystalline PERC products, as developers stockpile modules and other equipment in the lead-up to the phaseout of the Investment Tax Credit and continue to cope with Section 201 tariffs.

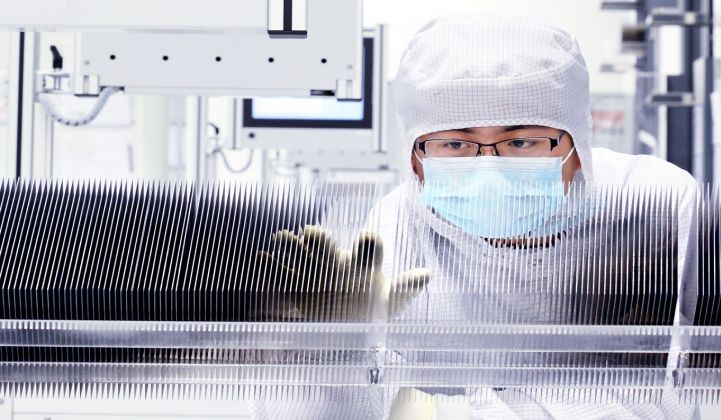

While those supply constraints are expected to loosen in 2020, the suit had potentially broad implications for the U.S. solar market. JinkoSolar is the largest producer of modules globally, with over 16 gigawatts of capacity. Longi is not far behind, with 15 gigawatts, according to data from WoodMac. All three of the respondents as well as Hanwha are among the world’s largest producers of mono PERC cells and modules, the technology the solar industry now favors.

During the stay and potential appeals, imports from REC, Longi and Jinko can continue. Hanwha is also pursuing similar cases in Australia, against only Jinko and Longi, and in Germany, against only Jinko and REC. Both of those challenges are ongoing.

WoodMac senior solar analyst Xiaojing Sun said the suit points to “the confrontational or protectionist” dynamics currently at play among manufacturers looking to get an edge in the U.S. The industry is also now at odds over the Section 201 tariff exclusion the Trump administration granted for bifacial solar panels but then reversed.

"Manufacturers are leveraging a broad array of approaches to protect their U.S. market share, including costly lawsuits and lobbying efforts," said Sun. “Manufacturers like First Solar and Hanwha, and previously SolarWorld and Suniva, are leading the charge to impose and sustain tariffs.”

Those disagreements may be sorted out behind the scenes at SEIA: Both Jinko and Hanwha now sit on the organization's board, with the former officially joining today.

This story has been updated with comment from Hanwha Q Cells.