The U.S. energy storage market continued its rapid expansion in the third quarter of 2018, as new state storage incentives and FERC Order 841 have doubled the country’s pipeline of projects to a record-setting 33 gigawatts.

But battery supply constraints, slower-than-expected progress by some utilities, and new fire codes in the key market of California are creating headwinds for the industry.

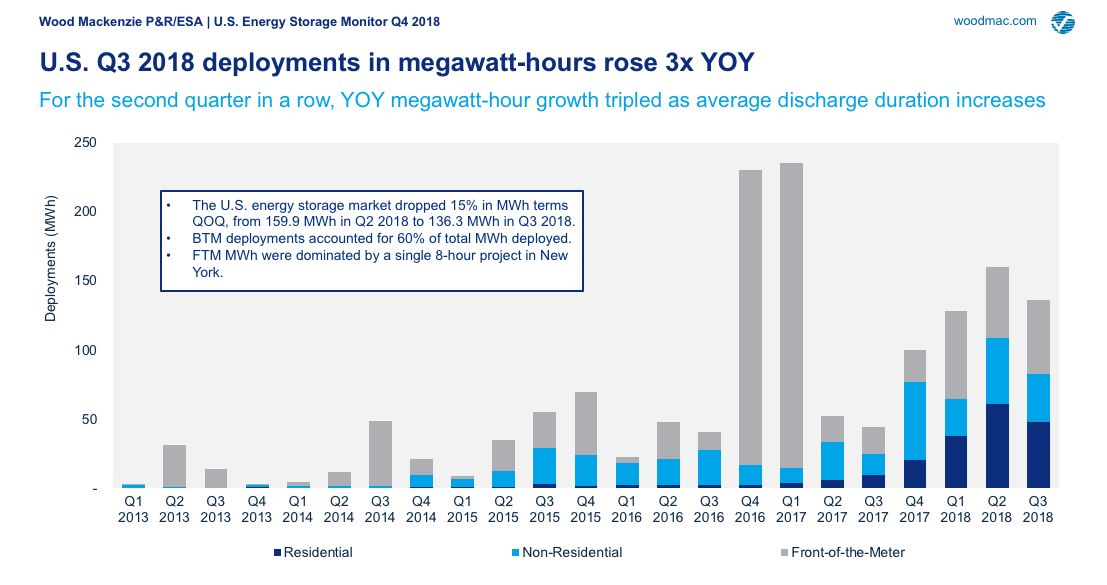

These are some of the key data points from the U.S. Energy Storage Monitor released this week by Wood Mackenzie Power & Renewables and the Energy Storage Association, which reported 61.3 megawatts and 136.3 megawatt-hours of storage deployed in the third quarter of the year. These are slightly below the second quarter’s figures, but nearly twice the scale of projects reported from the same quarter last year.

And the types of projects being deployed have shifted over the past year as well. For example, the third quarter’s front-of-meter, utility-scale battery projects were down 14 percent year-over-year when measured in terms of their megawatt power ratings. But in terms of megawatt-hours — how long they can provide their rated power capacity — the projects deployed in the third quarter were up 178 percent compared to the same quarter last year.

This is largely because, unlike the short-duration frequency regulation projects that have made up the lion’s share of historical front-of-meter deployments, more recent projects are starting to tackle longer-duration challenges such as providing capacity and load shifting. Four-hour systems are becoming the norm for front-of-meter projects, the report noted.

In terms of sheer duration of storage deployed, 2018 hasn’t yet caught up to the records set by the massive Aliso Canyon procurements in California during late 2016 and early 2017. But a host of policy and market developments are setting the stage for faster storage growth, such as Arizona's continued push into solar-plus-storage projects, Xcel Energy’s plan for 275 megawatts of batteries to support nearly 2 gigawatts of wind and solar power, or NV Energy’s plan for 100 megawatts of storage to accompany more than a gigawatt of new solar.

As for behind-the-meter deployments, the third quarter’s tally in residential and commercial systems fell 24 percent from the second quarter of the year — but it’s still the second-strongest quarter on record, and the second quarter in a row that outpaced all 12 months of 2017 in terms of new systems deployed. Behind-the-meter batteries made up nearly two-thirds of all megawatt-hours deployed in the third quarter, with California maintaining its lead in both residential and non-residential sectors.

By the end of the year, Wood Mackenzie forecasts that 686 megawatt-hours of energy storage will have been deployed across the country, with California leading with cumulative deployments of 334 megawatts to date, ahead of second-place PJM with 263 megawatts, and the rest of the country with 133 megawatts.

The report points to surging interest across a variety of new state markets, from stalwarts like New York and Massachusetts, to Missouri, Mississippi, Nebraska and Oklahoma. “Developers in markets across the entire country are seeing the raw economic potential that energy storage can provide, and they’re trying to get their foot in the door in key interconnection territories prior to FERC Order 841's mandated changes going into effect,” said Dan Finn-Foley, senior energy storage analyst with Wood Mackenzie.

While Wood Mackenzie Power & Renewables still projects that U.S. energy storage will be a $4.5 billion market by 2023, it has reduced its previous deployment forecasts for that year by about 4 percent, and it forecasts 2019 and 2020 growth to be a more substantial 21 percent, in light of emerging challenges to the industry.

Some of these are a result of its successes thus far, such as the battery supply constraints from Tesla and other vendors that have already slowed growth rates this year and through the first half of 2019 in the residential sector, with effects trickling into 2020 in the front-of-the-meter segment given their longer timelines.

Others are due to policy changes outside the industry’s control, such as the more stringent fire codes enacted in California this year that will create challenges for non-residential behind-the-meter battery installations in the state that still accounts for nine-tenths of this market.

***

The report's executive summary can be downloaded here. WoodMac clients can access the full report here.