This has been a busy month for news on the electric vehicle front — and we’re not just talking about Tesla’s latest quarterly earnings or the latest investments into cutting-edge EV charging technologies and business models.

At the federal level, the Trump administration’s moves to roll back federal fuel economy standards has pushed the country’s big electric utility trade groups into common cause with the EV industry, demanding that EVs retain some value in whatever fuel economy rules emerge from the process.

And in California, the state promising to keep its clean car rules in defiance of the EPA, regulators are expected next week to vote on utility plans to invest more than $500 million in EV charging infrastructure. It’s the country’s biggest investment to date into solving the chicken-and-egg problem of getting enough recharging stations in the field to give consumers the confidence that their new EVs won't be left stranded at the roadside.

There’s a good reason why utilities are so wedded to EVs. In a world of projected flat load growth and increasing competition from solar PV and other forms of distributed energy, EVs are a very welcome new source of load growth. This new load could be a threat or a boon to utilities, depending on how it’s managed.

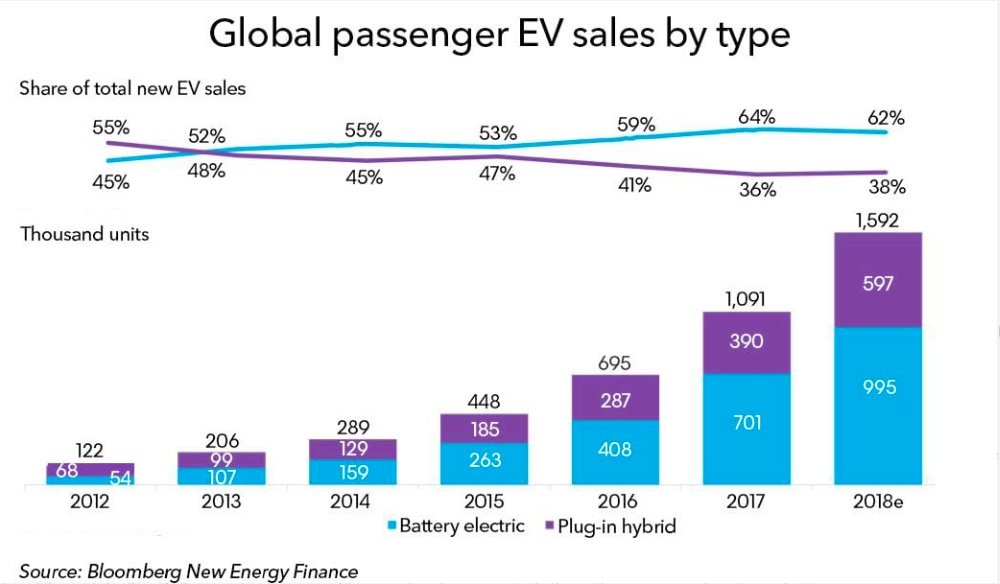

These political-policy maneuverings and grand infrastructure investments may seem like overkill to the casual observer of the EV market. As the U.S. Energy Information Administration reminded in a note this week, sales of EVs, plug-in hybrids and hybrid-electric vehicles have remained between 2.5 percent and 4 percent of all light-duty vehicle sales from 2012 through 2017, despite the near-doubling of available models.

But this snapshot of the past and present may well fail to capture the immense growth potential for electrifying the transportation sector. As Bloomberg New Energy Finance noted in its latest update to its global EV projections released this month, China will be the world’s biggest market for EVs, and is seeking to become the “Detroit of electric cars” as well. And the market for light-duty vehicles may well be dwarfed by the electrification of fleet vehicles, including city buses — a highlight of BNEF’s new report.

Looking out to 2030 and beyond, EV adoption will be an important part of the trend away from fossil fuels and toward cleaner electricity. That’s a concern for oil and gas majors like Shell, which has made EVs an integral part of its diversification efforts, as described in its recently released “Sky” scenario.

And the electrification of transportation has major implications for the fossil fuel industry writ large — a subject that receives a full review in Wood Mackenzie’s recently released Energy View to 2035 report. Let’s take a look at what these three reports have to say about electric vehicles’ role in the world’s future energy mix.

BNEF: A broadening road for EVs, but infrastructure challenges ahead

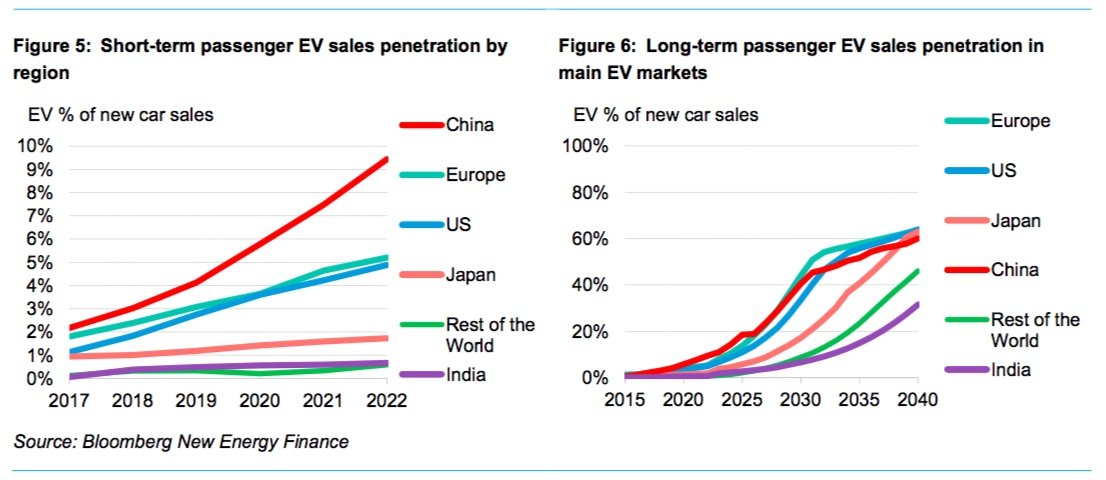

Bloomberg New Energy Finance's latest Electric Vehicle Outlook 2018 report shows sales of EVs increasing from a record 1.1 million worldwide last year to 11 million in 2025, and then surging to 30 million in 2030 as they become more cost-effective than internal combustion engine (ICE) cars. By 2040, about 60 million EVs will have been sold, equivalent to 55 percent of the global light-duty vehicle market.

This growth is primarily driven by China, where BNEF has nearly doubled its long-term projections from its 2017 forecast, “based on policy developments, rising commitments from automakers and urban ICE restrictions” — that is, big cities in China banning fossil fueled cars. China will account for nearly half of global EV sales in 2025 and nearly two-fifths of global sales in 2030.

This rapid growth is driven by several factors. First is cost reduction, driven by lithium-ion battery prices that have fallen from about $1,000 per kilowatt-hour in 2010 to a low of $209 per kilowatt-hour at the end of 2017 — a remarkable 79 percent drop in seven years. The average energy density of EV batteries is also improving at around 5 to 7 percent per year, BNEF noted.

Cheaper and better batteries, plus economies of scale, will start to tip the balance on cost-competitiveness versus ICE vehicles, with EVs becoming competitive on an unsubsidized basis starting in 2024, and reaching parity in most markets by 2029, it projects. Of course, there are limits to how cheap batteries can get — “for battery pack prices to fall significantly below $100/kWh, a step change in technology will likely be needed,” BNEF wrote.

On the policy front, governments around the world are offering generous EV purchase incentives that are driving up sales forecasts. BNEF has changed its "views on Germany and Japan due to increased EV sales there in 2017 and rising commitments to EVs from domestic automakers in those countries,” for example. Forecasts for France, the U.K. and the U.S. have been “adjusted to a lesser extent.”

This adoption rate varies widely from country to country. By 2030, BNEF predicts that EVs will hit 41 percent of sales in China, but just 7 percent in India. In Europe, Germany is set to lead with EVs reaching over 70% of sales by 2040. “A more globally differentiated auto market presents real challenges for automakers as they look to optimize where they spend their efforts.”

BNEF also pointed to the importance of city policies driving EV sales, primarily in China. “In 2017, 21 percent of all global EV sales were in just six Chinese cities, all of which have significant restrictions on buying and using new internal combustion engine vehicles,” it noted.

Finally, BNEF noted, automakers are making real commitments to EVs. Volkswagen, Daimler, Nissan, Volvo and other global automakers have all made aggressive plans to electrify their vehicles over the next 10 years. In China, companies like Chang’an are committing to sell only electric vehicles after 2025.

BNEF highlights two major challenges to this growth, however. The first is a projected shortage of cobalt, an important ingredient in most lithium-ion battery chemistries today. “We view cobalt supply as one of the largest potential risks to EV sales over the next 5 to 7 years,” the report noted, although it doesn’t see a near-term risk stemming from the key element of lithium.

The second challenge is EV-charging infrastructure. “While there are some sustainable business models emerging in Europe and China in both slow and fast charging, regulators will need to continue to support the rollout of charging assets through incentives, subsidies and better rate schedules, especially in China and the U.S. We still believe that urbanization and the associated lack of privately owned parking could lead to a slowdown of EV adoption despite competitive EV economics.”

To put the charging challenge in context, BNEF projects that electricity demand from EVs and buses will grow from 63 terawatt-hours to 2,000 terawatt-hours from 2018 to 2040, adding about 6 percent to global electricity demand in 2040. Electrified buses and cars will displace a combined 7.3 million barrels per day of transportation fuel by that time, it noted — but that displaced fuel will have to be made up for by electricity that’s much cleaner, if EVs are to serve in reducing the world’s carbon dioxide output.

Wood Mackenzie: The long view, from an all-fuels perspective

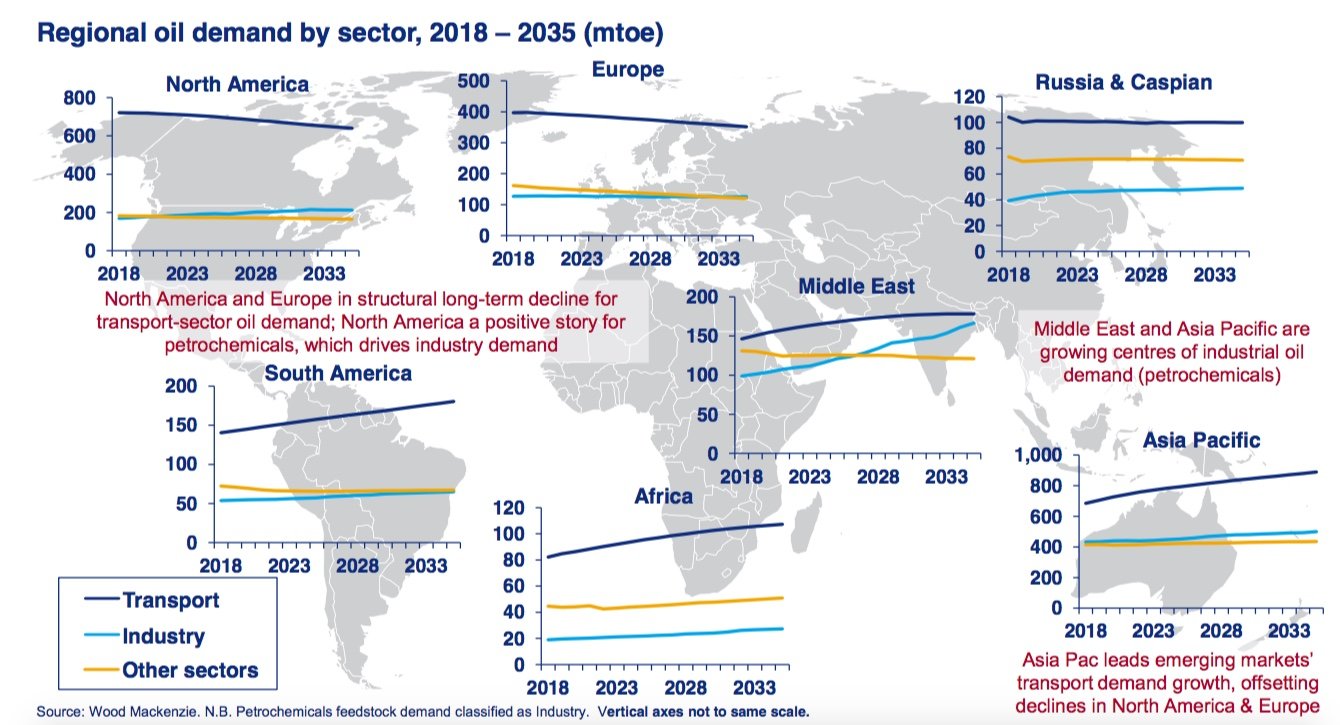

Wood Mackenzie’s Energy View to 2035 report takes on the challenge of predicting how decarbonization, the rise of renewable energy, and the spread of electrification into sectors such as industry and transportation will change global outlooks for the oil, gas, coal and nuclear industries over the next two decades. In that context, EVs play an important role, but one interconnected with many other imperatives, such as electrifying fast-growing industrial energy demand.

Broadly speaking, “a global trend toward electrification is clearly visible in the Energy View to 2035,” the report states. Globally, electricity demand will grow twice as fast as fossil fuels, rising to 27 percent of global energy supply by 2035, although only China and India will see electrification surpass 25 percent of total energy demand.

“In transport, electricity will outpace underlying demand growth in most regions” by 2035, the report notes. But with a vast existing fleet of fossil-fueled vehicles remaining on the roads, “electricity share of transport demand remains tiny in 2035,” the report states, although “the impact is beginning to be felt — and demand risk is to the upside.”

As with BNEF, Wood Mackenzie saw wide regional variations in the uptake of EVs, as well as broader efforts to reduce fossil fuel consumption in the transportation sector. But unlike BNEF, it looked at the subject from the point of view of the oil industry.

Shell’s Sky Scenario: How an oil company is adapting to electric vehicles

Shell’s energy transition report released last month (PDF) got a lot of attention for the oil and gas major’s unveiling of its “Sky scenario” — a “challenging but technically possible and economically plausible pathway for the world to achieve the temperature goal of the Paris Agreement.”

The report touches on electric transportation as a relatively small, but growing, part of Shell’s plan to adapt to a decarbonized future. By 2030, it predicts the percentage of ICE cars on the road will fall to about 75 percent, with EVs making up more than half of global new passenger car sales by then. That figure will range from up to 100 percent of new cars in China and Western Europe by 2030, and in North America by 2035. But countries that lack the energy infrastructure to support an EV transition, such as India and those in Africa, will take longer to make the change, it wrote.

“Electricity, including from renewable sources, will be a large part of Shell’s future as the world moves to lower-carbon energy,” the report notes. To get there, Shell has been acquiring companies, such as Texas-based power producer and retailer MP2 Energy and U.K. independent energy provider First Utility last year, and investing in others, such as German residential battery-solar system provider sonnen.

Last year, Shell also acquired Netherlands-based NewMotion, which has more than 50,000 public charge points across 25 countries in Europe, and partnered with Ionity to gain access to its fast-charging stations across 10 European countries, as well as building its own network of fast-charging points at its gas stations in the Netherlands and the U.K. Shell is also piloting smart-charging technology in three projects in the U.K., Germany and the U.S., and is “looking for opportunities on a larger scale to use this expertise.”