As news broke today that President Trump is planning to withdraw from the Paris climate agreement, two East Coast companies made final arrangements to shutter three coal-fired power plants.

On June 1, Public Service Enterprise Group, the parent of PSEG Power, will retire the two largest coal plants remaining in New Jersey. The Mercer and Hudson generating stations will close on Thursday, as inexpensive natural gas continues to force coal off of the grid in states across the country.

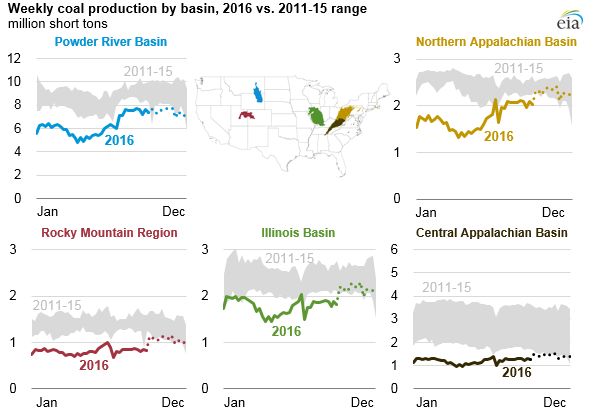

Natural gas prices hit their lowest levels in nearly 20 years in 2016. Meanwhile, U.S. coal use declined by 18 percent nationwide last year, and coal production in all major regions fell by at least 15 percent, according to the Energy Information Administration.

“The sustained low prices of natural gas have put economic pressure on these plants for some time. In that context, we could not justify the significant investment required to upgrade these plants to meet the new reliability standards,” said Bill Levis, president and chief operating officer of PSEG Power, in a statement.

PSEG Power continues to advocate for fuel diversity, both in its generation fleet and in the PJM market, according to a company press release. With this week's coal plant retirements, New Jersey’s energy will be split almost evenly between nuclear and natural gas, with renewable energy making up a small but growing portion of the electricity mix.

PSEG still owns a coal-fired power plant in Connecticut, and has ownership stakes in western Pennsylvania plants. CEO Ralph Izzo has long touted coal as a prudent investment in a volatile energy market, but recently reversed course. Izzo told NJ Spotlight that the company made a bet on natural gas prices and "got that wrong." He added that PSEG will not be investing in any new coal going forward.

Meanwhile, the Brayton Point Power Station in Somerset, Massachusetts -- the largest coal plant in New England -- will close for good today.

A decade ago, plant owner Dominion Energy spent $1 billion to clean up the Somerset plant, which was the state’s No. 1 polluter and has long faced opposition from environmental groups. But the upgrades did little to help.

On 2014, Dominion sold Brayton Point to the private equity firm Energy Capital Partners for a fraction of the environmental upgrade costs. Just six weeks later, Energy Capital Partners announced that Brayton Point would close in three years.

As in other regions of the country, natural gas is making up an increasing portion of New England’s electricity mix. In the year 2000, natural gas generated less than 20 percent of the region’s energy; today it supplies nearly 60 percent. Over the same period, coal use has declined from providing 12 percent of New England’s electricity to just 3 percent.

The New England ISO is now working to ensure a reliable supply of natural gas and pipelines to carry it. At the same time, the region is embracing alternatives. Massachusetts is already one of the nation’s leading solar markets. Legislators have also mandated that the state procure 1,600 megawatts of offshore wind power and another 1,200 megawatts of hydropower or other renewable resources going forward to replace the declining supply of coal.

Coal: The lone voice opposed to Paris

President Trump has pledged to revive the U.S. coal industry and put coal miners back to work. This campaign promise motivated his decision to dismantle the EPA Clean Power Plan, and is likely driving the administration to pull out of the Paris climate agreement.

Sources have told several news outlets this week that Trump has decided to withdraw from the global accord. However, these reports have yet to be confirmed directly by the White House.

Axios was the first to report that a small team, including EPA Administrator Scott Pruitt, is spearheading the withdrawal plan. “They're deciding on whether to initiate a full, formal withdrawal -- which could take 3 years -- or exiting the underlying United Nations climate change treaty, which would be faster but more extreme,” Jonathan Swan wrote.

Whatever the outcome, Trump is expected to deliver a decision on the Paris Agreement this week. He tweeted this morning: "I will be announcing my decision on the Paris Accord over the next few days. MAKE AMERICA GREAT AGAIN!"

Major U.S. corporations from across industry sectors have urged Trump to hold up the deal. Tesla CEO Elon Musk said today that he will quit the president's advisory councils if the administration pulls out of the Paris Agreement. In another sign of where business interests lie, ExxonMobil shareholders voted with a 62 percent majority today in favor of requiring the oil and gas giant to assess and disclose how it is adapting its business for the transition to a low-carbon future.

The CEO of coal mining giant Murray Energy is one of the few business leaders encouraging Trump to quit the Paris accord. Meanwhile, experts from across the political spectrum, including the president's top economic advisor, have determined that the Trump administration cannot revive the aging U.S. coal industry -- at least not without great expense.

Coal trends don't replace a climate deal

Since 2010, Sierra Club’s “Beyond Coal” campaign has tracked the retirement of 253 coal-fired power plants, with 270 plants still remaining. Since Trump was elected, seven coal plants have retired in six states, said John Coequyt, global climate policy director at Sierra Club, on a call with reporters today. That tally includes the New Jersey and Massachusetts plants shuttering this week.

PSEG rejected that the notion that environmental pressures triggered the closure of the New Jersey coal plants -- the utility recently spent $1 billion on new pollution controls to meet EPA mandates. The issue, according to PSEG's senior director of operations Bill Thompson, is "just economics."

The economic motivation to shift away from coal is a sign that the trend is likely to continue, regardless of what Trump decides to do with respect to the Paris Agreement. A recent Reuters survey found that even utilities opposed to President Obama’s Clean Power Plan have no intention of returning to coal. And the Sierra Club expects the ongoing coal retirement trajectory to put the U.S. on a path to achieve the Clean Power Plan emissions target around 2025.

But current trends do not guarantee that the U.S. will meet its Paris commitment to reduce domestic greenhouse gas emissions by 26 to 28 percent below 2005 levels by the year 2025 -- absent a global climate accord.

“Whether we can achieve the actual Paris Agreement targets is harder to project because we don't know what President Trump will do in a host of other sectors, and those matter a lot to whether we can meet the targets,” said Coequyt. While the Sierra Club anticipates cheap natural gas and renewable energy will continue to displace coal, “It’s still unclear the degree to which the transition will continue,” he said.