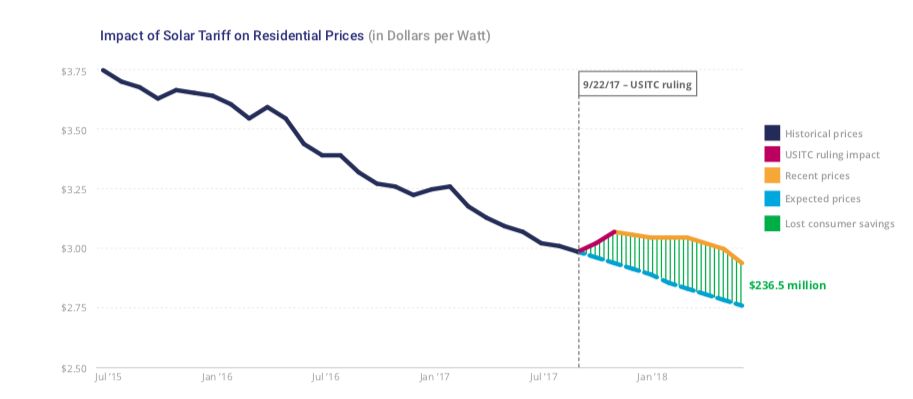

Customers started paying elevated prices immediately after the U.S. International Trade Commission announced its finding of “serious injury” in the Section 201 trade case, according to a recent report from solar marketplace EnergySage.

Using the average tariff-related customer price increase of $0.16 per watt applied to all residential purchases since the U.S. International Trade Commission’s decision, EnergySage found the tariffs added $236.5 million to bills for solar projects.

After the initial spike from the U.S. International Trade Commission's ruling, which EnergySage said came out to $0.07 per watt from September to November, costs leveled out. Prices remain elevated through the administration's official tariff determination in late January, but continue to decline — just not at the pace the industry previously expected. According to EnergySage, customers shopping on its site between February and June of this year saw prices quoted that were 5.6 percent higher than would have otherwise been expected.

Source: EnergySage

EnergySage said solar system prices reached $3.12 per watt in H1 2018. Data from Wood Mackenzie Power & Renewables puts the price a bit lower, at $3.02 per watt DC. According to WoodMac, the U.S. now claims the title of most expensive residential market in the world.

Even with those numbers, EnergySage cast the industry with an optimistic hue.

“Despite these recent hurdles, the residential solar industry remains poised for tremendous growth over the next few years,” said CEO and founder Vikram Aggarwal. “All-time highs in consumer interest for solar-plus-storage, combined with falling prices and greater transparency, have mitigated the impact of these tariffs.”

Analysis from WoodMac shows the optimism isn’t misplaced. Though Senior Solar Analyst Ben Gallagher said the industry must cope with “near-term risk” on pricing, analysts project that system pricing will fall to $2.16 per watt by the end of 2023 and that modules prices will return to H1 2017 prices by the middle of next year.

"Looking at the data, either EnergySage's or ours, it is undeniable that Section 201 impacted PV system costs and prices,” said Gallagher. “However, we are currently seeing system pricing fall in H2 2018. With the global module market in oversupply, U.S. pricing for modules is rapidly falling even when taking the tariff into account."

A recent New York Times report highlighted the overlaps between the areas most impacted by Chinese tariffs and the areas that are home to the majority of Trump’s base. In contrast, EnergySage’s state analysis indicates solar tariffs have hit both red and blue states. In Arizona, for instance, prices increased 7.8 percent between H2 2017 and H1 2018. Michigan’s prices spiked by 4.1 percent in that timeframe, while Maryland’s increased by 10.9 percent and California’s fell by 1.6 percent.

Though overall prices continue to decline nationally, in an analysis of 12 states EnergySage found that seven of them saw increasing average prices between H2 2017 and H1 2018. Only two, California and New York, experienced decreases. Those states have historically high costs compared to the national average.

Generally, EnergySage said fluctuations in state solar markets demonstrate a move toward the national average price.

EnergySage’s report comes just as the solar industry stares down another tariff of 10 percent, rising to 25 percent in January, for inverters. Those duties will mean price increases, but that's likely to be a short-term issue in the context of what Gallagher calls “drastic cost reductions” within a maturing industry.