Long-duration grid storage company Highview Power announced Tuesday it had raised a major equity investment to support its journey to market.

Global industrial conglomerate Sumitomo Heavy Industries invested $46 million in Highview, becoming the largest minority shareholder in the company. The money will support Highview’s quest to commercialize large-scale energy storage plants, a crucial component for a power system with large amounts of renewable generation.

“For Sumitomo Heavy Industries, this is not a venture capital investment — this is a strategic bet,” Highview President and CEO Javier Cavada told Greentech Media. “This is a huge corporation that sees this [technology] as a cornerstone of its future.”

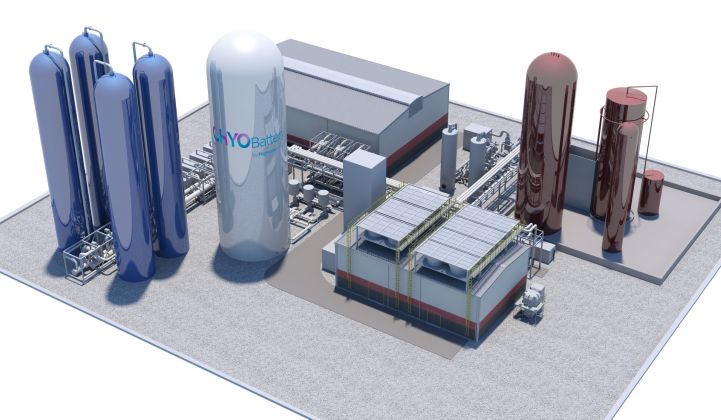

Highview currently operates two pilot plants in the U.K. that showcase its cryogenic thermal storage design, which uses well-known equipment from other industries to minimize technology risk. With several years of field-testing under its belt, the company began developing full-scale plants in the U.K. and Vermont last year.

In the long term, Highview aims to supply its technology to other power plant developers, but for early projects, the company chose to develop in-house. And since securing financing is difficult for conventional storage, not to mention unconventional long-duration technologies, Highview plans to use its own equity to finance the early deployments.

“We needed equity to be able to develop the projects,” said Cavada. “This investment is way bigger than all the money that was invested before into the company.”

Valuation soars past $300 million

Over its 15 years in operation, Highview had raised £25 million (roughly $32 million), according to Cavada. The new raise, which other investors could join, pegs the company’s valuation at $330 million.

“This is a big, big milestone,” he said. “There is no other energy storage company at this level of valuation.”

That’s a hard claim to verify because companies typically keep their valuations private, and there aren’t many pure-play grid storage companies to be found in the public markets. Cavada attributes his company’s value to its ownership of intellectual property for a storage technology whose time has finally come.

Companies have spent years developing devices to store power for more hours than lithium-ion batteries can handle cost-effectively. The chief obstacle, besides outrunning persistent cost declines from lithium-ion manufacturers, was that few customers needed to buy long-duration storage in years past.

That’s starting to change, as renewables penetration in certain markets makes it worthwhile to build bulk electricity storage capacity beyond the pumped hydro facilities built in decades past. With a growing roster of states legally committed to 100 percent carbon-free power, those jurisdictions will also need some way of ensuring capacity when solar and wind production dips. And remote and island communities are finding that renewable microgrids can save them money compared to burning imported diesel.

Big investors warm to long-duration storage

Investor dollars have followed the market pull, especially in the last six months: Gravity storage startup Energy Vault pulled in a record $110 million investment from SoftBank, electrochemical seasonal storage startup Form Energy raised $40 million and iron flow battery maker ESS raised $30 million.

In contrast to startups still refining their technology, Cavada considers Highview finished with the research and development phase. He’s developing projects like the two that Highview announced last year, both of which are co-developed with a partner company to share the financial load. Neither project has a contract finalized, though the new infusion of equity on Highview’s balance sheet may play a role in closing those deals.

The investment could lead to other forms of collaboration with Sumitomo SHI FW, the subsidiary formed with U.S.-based power equipment company Foster Wheeler in 2017. The Foster Wheeler unit supplies thermal power plants around the world, specializing in “circulating fluidized-bed” steam generators. Now, it could develop cryogenic storage facilities with Highview as the technology supplier.

It’s not the first time a company by the name of Sumitomo has dipped into long-duration storage. A different business, Sumitomo Electric Industries, has been developing flow battery technology for years, which it installed stateside for utility San Diego Gas & Electric in a pilot subsidized by the Japanese government. Though billed as long-duration storage, that installation has capabilities well in line with conventional lithium-ion storage, just more expensive and with weaker roundtrip efficiency.

Sumitomo Electric Industries and Sumitomo Heavy Industries operate independently, despite the similar nomenclature, so these two long duration storage efforts will proceed independently as well.* In any case, there is room in the market for multiple approached to long term storage, Cavada said.

"The smart companies will invest in multiple technologies of energy storage," he noted.

*Updated to clarify the relationship between SEI and SHI.