For the past two years, Power Assure has been trying out a new approach to data center energy efficiency: turning servers themselves into power-aware, energy-shifting assets. The idea is to move beyond the individual data center as the core measure of energy value and take on the actual operations of the fleets of servers that do the computing work.

Imagine managing a data center’s server fleet to push certain energy-hungry operations to different times of the day, to help mitigate peak power loads or tap available green power production. Or consider being able to move real-time computing tasks to different servers or virtual server environments across a company’s data center portfolio -- for example, by regularly tapping otherwise-idle disaster recovery systems -- to take advantage of differences in energy prices across regions, or even across oceans and continents.

It’s a simple concept, but quite complex in its execution. Data center operators aren’t about to risk messing around with uptime and performance just to shave their energy bills. That means that anyone trying concepts like these will have to get some pretty noteworthy partners to join in and demonstrate how it works, preferably in a real-world deployment.

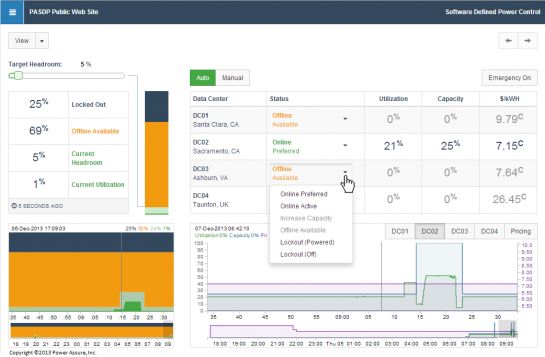

This week, Power Assure and partner RagingWire are doing just that. In a real-world demo taking place at the 2013 Gartner Data Center Conference in Las Vegas, the two will be switching computing loads between RagingWire’s data centers in Sacramento, Calif. and Ashburn, Virginia to adjust to real-time energy usage signals. They’ll also allow observers to watch servers in both data centers turn on and off via live webcam, as well as to log onto a test website to see for themselves how their sites are being switched from servers in California and Virginia, and back again.

“We don’t start with a data center at the top level,” Power Assure CEO Pete Malcolm told me in an interview last week. “We start with the thing that’s important, which is the application.” It’s all based on the Santa Clara, Calif.-based startup’s “software-defined power” technology, which details power use down to individual applications across physical or virtual server environments, then provides the software tools and policies to make use of that capability to drive an array of energy-oriented business cases.

Those include being able to power down idle servers, which is a major target of many IT-oriented data center efficiency approaches, given estimates that up to 85 percent of servers are using energy without doing work in most environments. Other technologies exist to power down idle servers, then kick them into gear when IT workloads require it -- but Power Assure’s method links specific applications to that process, while most other systems merely use CPU utilization as a metric, Malcolm said.

It also includes the ability to constantly use, and thus test, a company’s disaster recovery IT assets, to avoid the estimated 80 percent of disaster recovery failovers that don’t work or require human intervention, with resulting loss of uptime, revenue and reputational damage, he said.

Beyond that, however, “There are loads of other use cases, in responding to pricing, to demand response programs, all the way to participating in wholesale markets” for energy purchasing, he said. All told, “we can reduce your energy costs by doing this by at least 50 percent,” he said, and deliver a return on investment within six months after implementation.

“Without taking extreme cases, we can demonstrate...how these are very realistic numbers,” he added. According to Power Assure’s data, reduction of idle servers and wholesale power purchasing benefits drive the majority of those savings, at 45 percent and 20 percent to 40 percent, respectively. Demand charge reduction, demand response program participation and peak pricing reduction add single-digit savings on top of that.

For two 1-megawatt data centers with an annual energy bill of $2.2 million, making use of all these use cases could deliver savings of $1.2 million to $1.5 million per year, or roughly three to four times Power Assure’s installation and ongoing annual licensing costs.

“This is not something that every data center is going to be able to deploy tomorrow,” Malcolm noted. Data center operators will need to have multiple sites available to take advantage of energy price arbitrage between different utility service areas, for example. They’ll also have to take on a certain amount of upfront work to ensure that their IT environments match up with Power Assure’s metrics for measuring energy consumption per unit of computational work, known as PAR4.

“The reality is, yes, the configuration of your server matters to some extent,” he said. “But the overriding factor that causes power consumption is the CPU, or CPU-driven,” making the PAR4 measure a workable stand-in for energy-per-application.

While a handful of internet giants like Facebook, Google and Yahoo have custom-built their own servers and data center architectures to optimize efficiency, most data center owners and operators are using standard server equipment, either for their own purposes, or as providers for others at so-called colocation centers.

These colocation providers could use Power Assure’s software to actually track each customer’s energy use per application, then bill them only for the power they consumed, rather than tacking estimates of energy costs onto their bills, he said. That’s something that RagingWire is doing to try to differentiate itself from its competitors, he noted.

In October, Japan’s NTT announced plans to spend $350 million to take an 80 percent stake in RagingWire, which could give it an inside view of how Power Assure’s software could be put to use for the Japanese data center giant’s other operations, he said. Other Power Assure customers include NetApp, Twitter, NASA and other federal agencies, and the company’s partners include VMware, Cisco, Dell and IBM.

Investors include ABB, the Swiss grid giant with a significant share of data center power management business, and Dominion Energy Technologies, the investment arm of Dominion Power, the utility company that’s been a core partner in Power Assure’s grid-focused data center energy management work.

There are plenty of other contenders in the data center efficiency space. These range from companies focused on more efficiency facility management, such as SynapSense and Vigilent (formerly Federspiel Controls), to those tackling the IT loads in data centers, such as Sentilla, as well as JouleX, which Cisco bought for $107 million earlier this year.

Then there are IT giants like HP, IBM, Intel, Cisco, Microsoft and Oracle that are improving server performance per watt and integrating energy data more closely into their data center infrastructure management platforms, plus big grid players like ABB, Siemens, GE and Schneider Electric that are building up platforms to better manage their power systems in the data center.

Bringing the energy efficiency efforts inside the data center more into line with utility needs could be a major selling point for technologies that can dynamically control power consumption at the server level, Malcolm noted. “Data centers have never been able to participate in that before, but utilities are very keen that they be able to do it, because data centers are a huge user of power.”