This month, Tesla hits its first employment target with New York state, negotiated around the siting of its Gigafactory 2.

The deal, part of Governor Andrew Cuomo’s troubled “Buffalo Billion” development initiative, requires 500 workers by April 2019 and 1,460 citywide, with 500 in manufacturing by April 2020. In exchange Tesla received $750 million in sweeteners from the state to build and outfit the factory to produce its solar roof, a product that’s seen numerous delays.

Tesla told Greentech Media that it’s already met its 2019 target. But the company’s precarious financial position and whiplash sales strategies have others concerned about the future of the plant and the solar roof itself, which CEO Elon Musk has framed as a keystone product.

Challenges at the Buffalo plant are just one of many questions hanging over the future of Tesla’s solar business. Residential installations at the former SolarCity unit have dropped precipitously in recent years.

Tesla declined to comment on concerns about meeting its 2020 jobs target. But the uncertainty around Gigafactory 2 comes at a critical juncture for the company. Mixed signals abound.

In its latest quarterly financial report, Tesla called 2018 “the most pivotal year” in its history. In a January email announcing it would shrink its total workforce by 7 percent, the company also recognized it was “the most challenging.”

The automaker recently clocked its first quarters of profit in years, met seemingly impossible vehicle-production goals, and laid off large numbers of employees. It also shifted its sales strategy multiple times, first announcing it would close most of its retail stores, then saying it would keep “significantly more” stores open.

Several former Tesla employees told Greentech Media that meeting its job targets under those circumstances will be tough.

“At best, [meeting the jobs target] will be challenging for them,” said a former executive with knowledge of the development of the solar roof product and who left the company in 2017.

The move to pare back retail stores, where Tesla may have been able to generate leads for solar roof sales, would seem to further cloud the factory’s future, the former executive added.

"$1 million per job?"

At the end of 2018, Tesla reported over 800 employees at Gigafactory 2. About half are employees of Panasonic, Tesla’s partner at the plant. After cutting 7 percent of its overall workforce in January, Tesla told Greentech Media it still has more than 750 employees working there.

While that number is well above the target for 2019, a former production employee among those laid off in January voiced concerns about the 2020 state target.

“Before the layoffs, I thought they were going to be hitting it, because they were still looking for people. Toward the end of November, they were hiring [for] everything,” the employee said. “But after the layoffs happened, I do not think they’re going to be reaching that goal.”

State lawmakers share the concern.

“It would be my hope on behalf of our community that they meet the target, and that many people are gainfully employed there,” state Assembly Member Robin Schimminger, who represents a district that overlaps with part of Buffalo, said in an interview. “But they don’t seem to be on that trajectory at this point.”

Tesla committed to bringing 1,460 employees to Buffalo by 2020, and some of that pool may work outside the Gigafactory. It must deliver 5,000 jobs to New York within a decade of the facility’s completion, according to a 2016 filing with the Securities and Exchange Commission.

In exchange, the state would invest $750 million to build the plant and lease it back to the company for $2 a year plus utilities, according to a 2017 SEC filing. Starting in 2020, if Tesla fails to meet the agreement’s terms, it faces a penalty of $41.2 million for each year it falls short.

In February, state legislators grilled Howard Zemsky, the CEO of Empire State Development, the state’s economic development agency, about the jobs number and whether the state would enforce the penalty.

“So we spent $1 million per job?” asked state Senator Liz Krueger.

Tesla also has a deal with Panasonic associated with the plant, with Panasonic partnering to produce PV cells and modules and Tesla incorporating those cells into the solar roof. In exchange for a long-term purchase commitment from Tesla, Panasonic agreed to cover capital costs. Tesla declined to comment on whether Panasonic pays Tesla to lease space.

New York’s Department of Labor did not respond to requests for comment on Tesla’s reported job numbers. But ahead of the round of layoffs in January, Tesla did not file a notification tied to the state’s Worker Adjustment and Retraining Notification Act. That law requires businesses to give warning prior to layoffs if they impact 25+ workers that make up at least a third of all employees at the site. That suggests the layoffs didn’t significantly cut into Tesla’s employment at the plant.

A spokesperson at Empire State Development told Greentech Media “the state is confident Tesla will meet its obligations,” but confirmed it will enforce the penalty if the company does not.

Assembly Member Schimminger said he believes the state will hold Tesla to the agreement.

“If they were to walk away, they would walk away,” said Schimminger. “But [they] still have an obligation to the state of New York under the terms of that deal.”

“A very complex engineering feat”

Tesla introduced its solar roof in October of 2016, just ahead of officially acquiring SolarCity. Since that unveiling, information on product development and installations has been relatively scarce. The company has accepted solar roof orders through its website since 2017 and notes that customer installations are underway, but it doesn’t offer buyers a timeline on when installations may take place.

Media reports on the product have been concerning. In August, Reuters laid out delays at the Buffalo Gigafactory, which is supposed to produce 1 gigawatt of solar capacity per year when fully ramped. That report noted that, at the time, only 12 solar roof systems had been connected to the grid in California.

Tesla told Greentech Media that number is low but declined to offer specifics. According to an analysis of more recent records from the state's three largest investor-owned utilities, the state looks to have connected just 21.

Former employees say the solar roof’s development process has been difficult from the start.

At the time the previously quoted executive left the company, in 2017, the product was still in early stages. Developers were working on how to cut glass safely, negotiating weight constraints and coping with the product’s complicated installation.

“The solar roof approach of Tesla is unlike anything that has come in the past in terms of aesthetics. […] It’s making solar absolutely disappear on a roof,” said the former executive. “That’s a very complex engineering feat.”

Encumbering progress further: Each installation is basically bespoke.

In recent months, the U.S. Patent and Trademark Office published several applications Tesla filed in 2017 regarding solar roof tiles (patent applications are generally published 18 months after filed, though there are exceptions). One published in late February focuses on “flexible solar roofing modules.” Another, published in late March, concerns “optical-filtering coating for managing color of a solar roof tile.” Another published that month involves “moisture-resistant solar cells for solar roof tiles.”

Those applications imply work continues, and in its latest financial report, Tesla said it would ramp solar roof production in 2019 “with significantly improved manufacturing capabilities…based on the design iterations and testing underway.”

Several former employees suggested that not many roofs have been installed so far, though none could cite specific numbers.

“The [deployment] numbers that I think they had hoped for are probably not going to happen,” said another senior executive, who left the company last year.

A drag on the national rooftop solar market

Meanwhile, doubts continue to swirl about another critical piece of Tesla’s solar master plan: its downstream rooftop installation business.

For months, solar market analysts have warned that Tesla’s brand-driven and online-focused sales strategy, unprecedented among its peers, would likely hurt the company’s solar arm.

And though Elon Musk in March named 2019 “the year of the solar roof and Powerwall” and stopped by the Buffalo factory in April, Tesla’s residential solar business seems to be languishing.

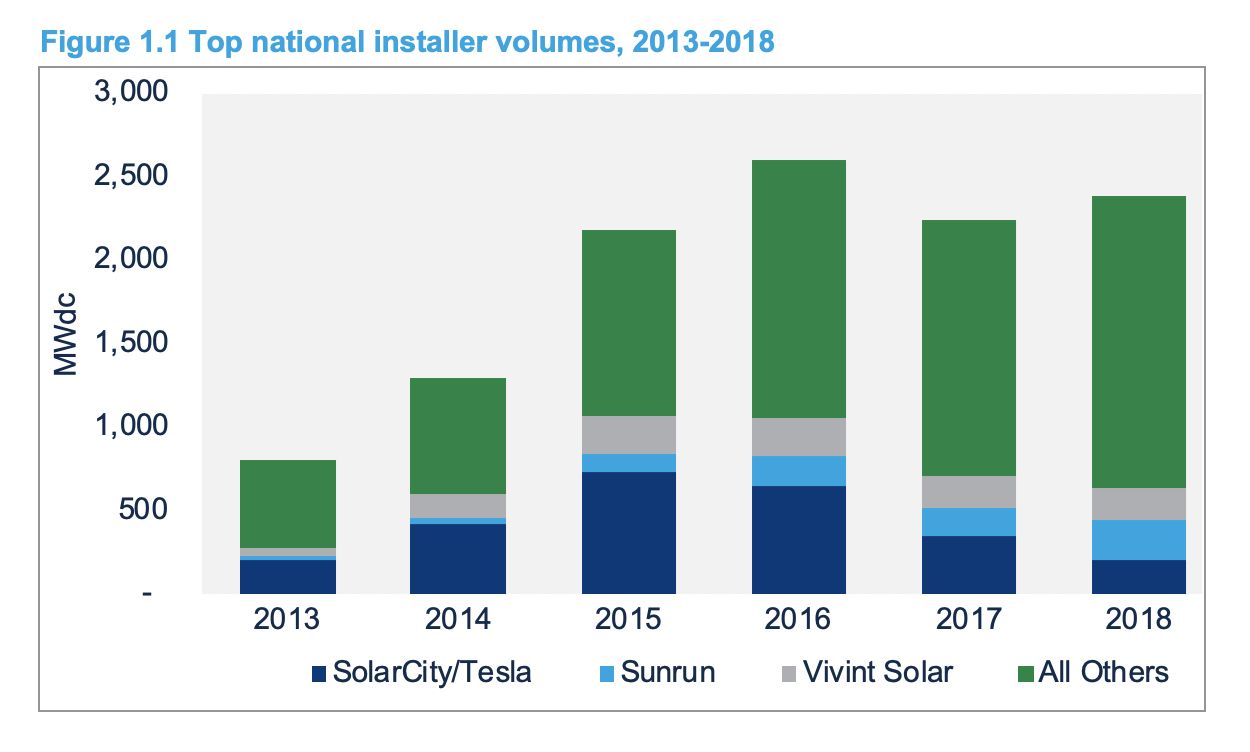

Data from Wood Mackenzie Power & Renewables shows the company’s residential installation volumes nearly halved from 650 megawatts in 2016 to 352 megawatts in 2017, and then tumbled again last year to 208 megawatts.

Source: Wood Mackenzie Power & Renewables

The pullback may be strategic. SVP of Energy Sanjay Shah has said the company doesn’t want to grow “just by chasing volume.”

In any case, Tesla Energy still makes up a small portion of the company’s overall business. Energy generation and storage revenues came in at $1.6 billion last year, compared to automotive revenue in excess of $18.5 billion.

Still, slowing sales of residential solar systems brings up the question of where the company’s solar roof product will go once the factory is online.

Analysts suggest that Tesla may plan to rely on its brand power to turn sales of its luxury vehicles into leads for its battery product and boutique solar roof.

That may not lead to the wide buy-in that Musk peddled as a linchpin in the sustainable Tesla lifestyle when the company acquired SolarCity. But Allison Mond, a senior solar analyst at WoodMac, says Tesla no longer seems to be selling that solar-powered life.

“It seems to me we’re just going to continue to see their installation volumes plummet,” she said.