For more than a year, PacifiCorp has been working on its integrated resources plan, or the forecast for the mix of energy resources the six-state, 1.9-million customer utility will need over the next 20 years.

Much of the focus on this year’s IRP has been on PacifiCorp’s coal-fired power plant fleet — how much of it could be retired early and replaced with wind, solar, energy storage and other carbon-free resources, and how much money that could save PacifiCorp’s customers.

While the numbers emerging from PacifiCorp’s analysis of these questions have shifted over time, they’ve consistently revealed an underlying fact: Closing some of its least competitive coal plants earlier than planned will save the Berkshire Hathaway-owned utility, and its customers, hundreds of millions of dollars over the next 20 years.

In fact, the figures are only getting better as the analysis becomes more thorough and realistic, in advance of an Oct. 18 deadline for filing its IRP.

The fundamentals

Take PacifiCorp’s presentation (PDF) to stakeholders last week in Portland, Ore., which revealed the most complete picture yet of how a 20-year plan that includes early coal retirements, new wind power and transmission from Wyoming, and utility-scale solar that comes with energy storage as a matter of course, can yield a more cost-effective future.

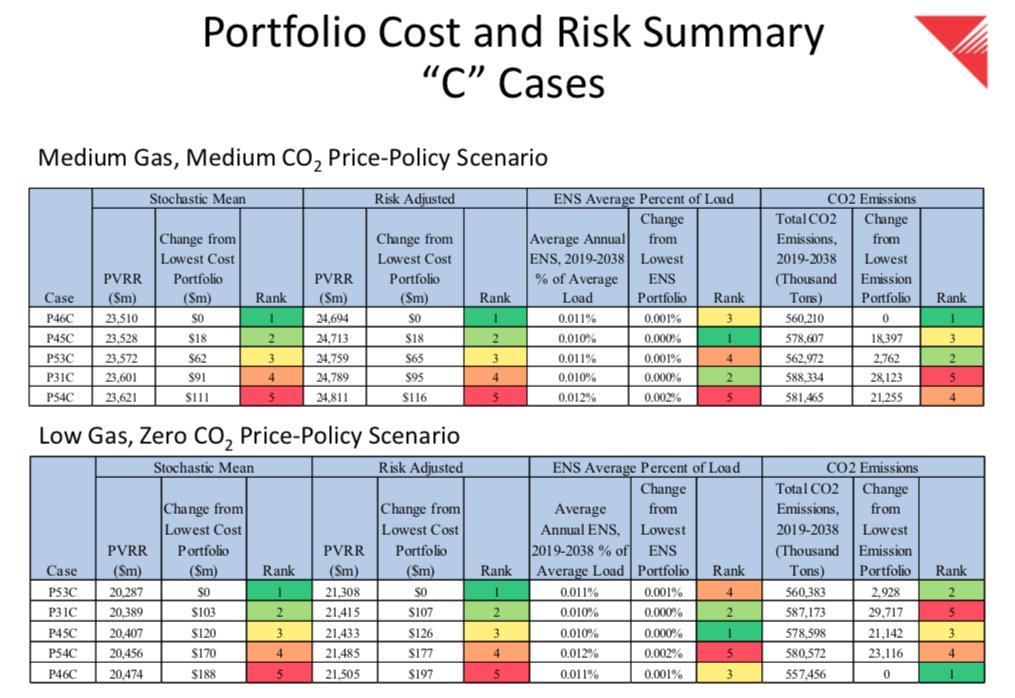

The latest analysis focuses on 30 cases, or combinations of future resources, that have emerged as the most cost-effective in terms of present value revenue requirement (PVRR), or how much each project would cost or save compared to a business-as-usual benchmark. For the five cases with the lowest system PVRR, PacifiCorp performed more granular reliability analysis (“B” series) and incremental analysis to evaluate solar-plus-battery resource options (“C” series) — distinctions we’ll explore later.

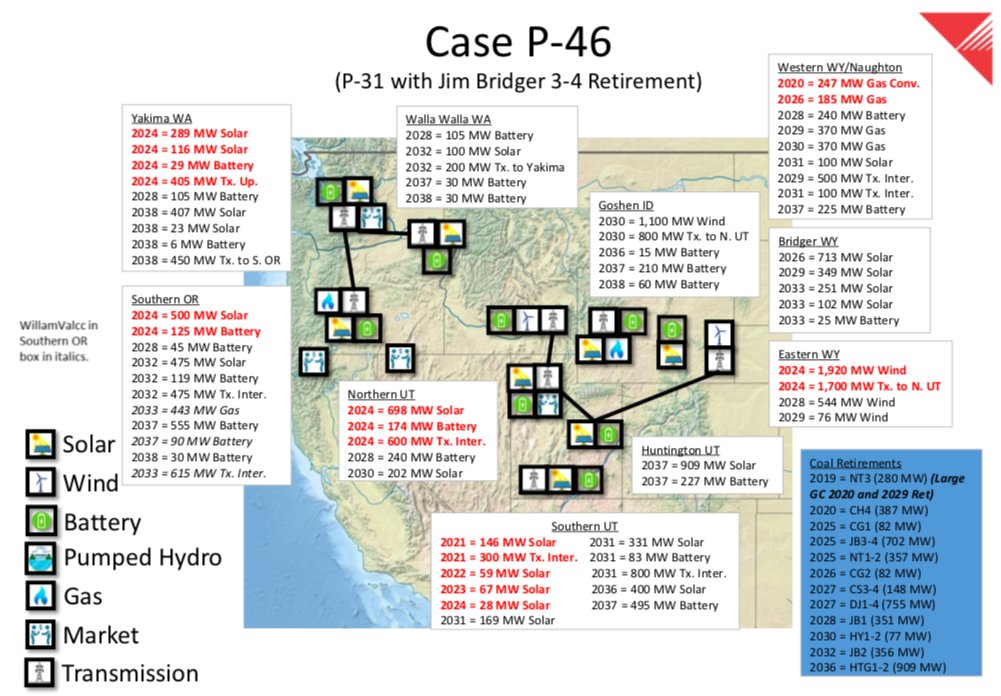

In raw dollar value, the top-performing portfolio, “P-46,” has four Wyoming coal-fired units closing in 2025 — Jim Bridger 3 and 4, currently scheduled to close in 2037, and Naughton 1 and 2, otherwise set to close in 2029. It also has a portfolio of resources to replace them, including natural gas, demand-side resources, transmission, and “front office transactions,” or firm market purchases from other parties.

But it also includes hundreds of megawatts of new wind power, solar power and energy storage capacity, much of it requiring additions to existing development plans in the six states PacifiCorp covers. This new capacity is shown in red typeface in the following slide from last week’s presentation.

All told, this mix of retirements and replacement resources is modeled to save $599 million over 20 years, the most savings out of the five top cases. Another case that would close the Bridger units slightly later came in at $545 million in savings.

Whatever the dates chosen for closing coal plants, renewables will play a major role in PacifiCorp's resource mix. Its latest analysis lays out a future that will require 4 gigawatts to 4.4 gigawatts of new renewables by 2027, along with 518 megawatts to 729 megawatts of energy storage. By 2038, those figures will grow to about 9.5 gigawatts of new renewables and more than 3.3 gigawatts of battery capacity.

Extending coal closure deadlines

The $559 million in savings delivered from PacifiCorp's latest best-case scenario is notable, in that it's more than twice the $248 million in savings promised in an April analysis of closing the same Wyoming power plants. But as PacifiCorp spokesperson Bob Gravely noted in an email, that April analysis was bound to an earlier 2022 retirement date by the Oregon Public Utility Commission, which ordered it to undertake its first-ever analysis of the cost-effectiveness of its coal fleet back in 2017.

PacifiCorp's responses to this fundamental request have shifted in their scope, assumptions and baselines over time. For example, in December, a raw economic analysis showed that 13 of PacifiCorp’s 23 operating coal units in Montana, Colorado and Wyoming were more expensive than their cleaner-energy replacements across a range of scenarios.

But this study lacked an analysis of the reliability effects of closing so many plants early — a gap that April’s study helped close by considering a set of “retirement stacks” across its territory. This month’s analysis further expands the options before PacifiCorp, this time by loosening the scope of retirement dates it can model for the coal plants already identified as targets for early closure, Gravely wrote in an email.

“The case that presented the $599 million benefit, for example, includes a phasing of coal unit retirements primarily starting in 2025. A main reason for the difference in savings is the higher replacement resource costs for retiring the units in 2022 instead of at the later dates,” Gravely wrote.

In other words, replacing coal plants will be more cost-effective if PacifiCorp can have three more years to prepare, plan and wait for further price declines for core technologies like solar PV and long-duration batteries.

This could be seen as bad news for proponents of closing money-losing coal power plants as quickly as possible. But because the Oregon PUC’s 2022 deadline date was not linked to any specific requirement for PacifiCorp’s IRP, the newer study reflects a more realistic set of options before the utility.

For the Sierra Club, which has played a key role in pushing PacifiCorp and its regulators to publicize the data on its coal fleet, the latest data from its IRP process underscores the fact that closing coal plants makes economic sense, senior campaign representative Christopher Thomas said. But from a carbon-emissions impact, the clear winner among the utility’s five cases is clearly the one that closes half of the Jim Bridger coal plant in 2025 and closes the second half in 2032, rather than in 2037.

“The results show that we don't have to choose environmental protection or customer savings. We can have both," Thomas said. "Among the top options PacifiCorp is considering, the one that saves the most money also cuts the most carbon pollution."

This is borne out by PacifiCorp’s analysis across different future scenarios featuring different natural-gas prices and carbon emissions costs. The same “P-46C” case continued to yield the greatest cost reductions across every scenario, except one that envisions a “low gas, zero-carbon price-policy” future.

Opening up Wyoming wind and transmission

Extending the analysis past 2022 also allows for a greater set of renewable resources to become available, along with the transmission to carry them to market. Specifically, PacifiCorp’s latest analysis has modeled the impact of the Gateway South transmission project, which is one of a number of multibillion-dollar transmission projects in development to allow wind farms planned for Wyoming to carry their power westward.

This assumption allowed PacifiCorp to bring 1.9 gigawatts of eastern Wyoming wind to its portfolio by 2024, an addition that’s built into its total additional renewables figures. Gravely noted that the wind power in question would be eligible for the 40 percent federal Production Tax Credit.

PacifiCorp’s IRP already calls for more than $3 billion in investment into renewables over the coming years, including the addition of up to 1.2 gigawatts of new wind power in the Pacific Northwest and Rocky Mountain regions, along with major new transmission lines to carry it westward. Parent Berkshire Hathaway Energy, whose other utility subsidiaries include MidAmerican Energy and NV Energy, is the country's second-largest owner of wind capacity, with nearly 8 gigawatts clustered in Iowa and Wyoming, according to the American Wind Energy Association.

PacifiCorp’s new analysis also “enabled the availability of proxy solar resources in northern Utah,” as opposed to limiting solar modeling to the sunnier climes of southern Utah. This allowed its latest cases to include small, but significant, megawatts of solar in the part of the state that’s closest to existing load and transmission, the Sierra Club’s Thomas noted.

Adding "plus-storage" to all solar

But perhaps the most significant step in PacifiCorp’s new analysis was its “additional solar+battery analysis,” which altered its modeling methodology to test out a future in which all utility-scale solar comes with some energy storage included.

As explained in last week’s presentation, the utility had noticed that its existing two-step portfolio modeling process was frequently yielding situations in which the preponderance of low-cost solar led to “incremental battery resources [being] routinely added to remedy initial reliability shortfalls in each case.” PacifiCorp concluded that, if the modeling software could do it all in one step, “it would likely pair batteries with any of the new solar resources it initially added to take advantage of cost savings.”

To test that hypothesis, it used the workaround of barring the computer model from selecting any standalone solar in its initial portfolio, forcing it to select solar-plus-battery options. It then analyzed the results in terms of reliability compared to the portfolios created without the kludge, and found that “overall system PVRR was lower,” meaning a more cost-effective portfolio.

As PacifiCorp spokesperson Gravely explained, that’s largely because battery-backed solar is “more reliable in providing flexible capacity and reserves, which lowers reliability requirements.”

This is the same logic that’s driving record-setting solar-plus-storage deployments across the country, and at least according to this analysis, it holds true in the Pacific Northwest as well.