Station A, the San Francisco-based R&D center once owned by NRG Energy, is now a standalone company.

The Station A team developed a software platform to deploy distributed clean energy resources at commercial and industrial buildings across the United States. On Wednesday, the company announced a plan to make its software available to solar, energy storage and energy efficiency developers looking for a competitive advantage in existing markets, as well as to provide an entrée into still-nascent ones.

NRG still owns a minority stake in the spinout and remains an important customer. But Station A’s platform is now also being used by six other customers, including “some of the leading clean energy developers and technology providers across solar, energy storage and energy efficiency,” Kevin Berkemeyer, Station A’s co-founder and CEO, said in an interview.

Station A’s software now offers access to about 1 million commercial and industrial buildings in the U.S., Canada and Puerto Rico, along with the relevant data to determine the cost-effectiveness of different energy infrastructure investment options for each, he said. It’s largely meant as a tool to streamline the costly and time-consuming customer origination process.

“We enable them to analyze markets, to simulate different products, and to seek out and connect with energy users directly,” Berkemeyer said.

Berkemeyer led Station A’s development of its software, which started as a tool to help NRG find customers to fulfill its contract to provide 60 megawatts of energy efficiency, thermal energy storage, demand response and other behind-the-meter energy flexibility services for Southern California Edison. Last year it started offering the software platform to customers outside its parent company.

Working with big data

NRG’s role as a leading generation company, one of the country’s biggest energy retailers, and a big investor in wind and solar, has provided Station A with a lot of proprietary internal data to work with.

“We’ve been working on this since 2015, and have created a proprietary way to extract information from the publicly available data sets to create our own proprietary data sets and to link that information,” Berkemeyer said. “That’s enabled us to draw inferences and conclusions about the energy characteristics of those buildings and other characteristics that can inform energy choices.”

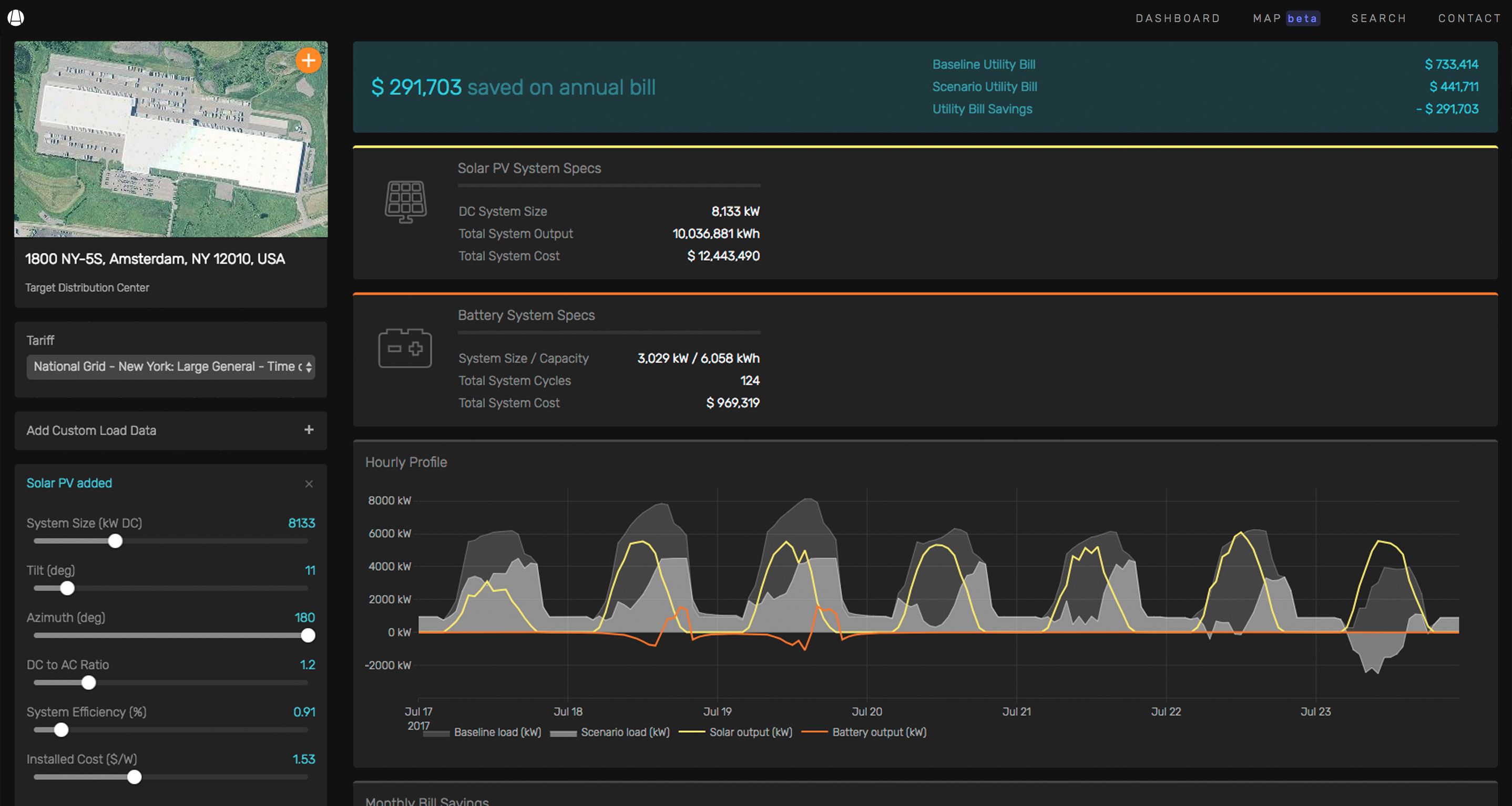

Station A software platform in action

Berkemeyer wouldn’t name any of Station A’s customers, noting that most are using its platform to gain advantages in competitive markets for behind-the-meter energy solutions. But he did say that those using its software have been able to cut customer-origination times roughly in half, and reduce “origination soft costs” by roughly one-third, compared to their previous manually driven processes for finding and landing customers.

“We’re currently automating a lot of the manual processes that are inherent to project development and origination services,” he said. From the more basic approaches of doing web searches and building spreadsheets to sort out potential customers, to more advanced data analytics and satellite-imaging approaches. “That kind of traditional processing is more of our competitor than other software offerings,” he said.

Other companies using similar big-data approaches to optimizing energy investments include startups such as Tendril, FirstFuel and Ecova's Retroficiency. But while energy project developers have invested lots of time and money into strengthening their own customer-origination processes, platforms that offer services to multiple customers, as Station A is now doing, are harder to come by, he said.

The business model

Station A earns money by charging its customers usage-based subscriptions for using its platform at present, he said. But it has also been interacting more and more with the “actual building owners and occupants” that its software has identified as potential customers. “We allow them to provide their own information, or correct the estimates we’re making around energy usage...[and] their electricity bill,” he said.

In recent weeks, Station A has begun to reach out to property owners and managers directly, building on its experience linking its current developer partners to their customers. This could open up a new line of business, he noted.

“As we start to create this marketplace, our intention is to capture value by originating projects more directly [and] charging an origination fee to developers,” said Berkemeyer.

He declined to discuss Station A’s financial performance at present, or describe the majority ownership structure of the newly spun-out company. But he did say that it is seeking funding to expand, including adding two more employees to its four-person staff. “Right now, our customers are our investors — that is, they’re paying customers. That’s the way we like it.”