New York state has some of the country’s most ambitious clean energy and carbon reduction goals. It has a massive energy storage mandate. And it's in the midst of creating new market structures for distributed energy resources under its Reforming the Energy Vision initiative.

In other words, it's a state that's transforming its energy structure at multiple levels — including its transmission grid and wholesale energy markets.

On Thursday, the New York Independent System Operator (NYISO), the state’s transmission system operator and market-maker, released its Power Trends 2019 report, highlighting how it’s adapting to this changing state energy ecosystem. Among key updates are NYISO’s progress toward a carbon pricing proposal that could make it the first grid operator in the country to put a price on carbon in its wholesale electricity market.

That plan, filed in December (PDF), would be an important step in a long-running struggle among clean energy advocates to establish a wholesale market value for the relative carbon intensity of the resources that serve it.

Mid-Atlantic grid operator PJM has also suggested launching a study of the potential to price carbon emissions in its energy market. But as a grid operator serving 13 states and the District of Columbia, PJM has a much more complex path toward reaching consensus on a plan than does NYISO, which serves a single state.

Thursday’s report noted that NYISO’s carbon pricing proposal “would further promote economic competition among suppliers in the NYISO’s markets by directly pricing a key environmental attribute in the markets,” and “help the state more efficiently attain its clean energy goals.”

The plan proposes a charge of $50 per ton of carbon dioxide emitted — “a value large enough to have a major impact on NYISO market dynamics,” according to energy industry consulting group ICF.

But ICF noted that this impact has drawn the opposition of NYISO stakeholders like utilities and power plant owners, and is likely to lead to challenges when NYISO submits the plan to the Federal Energy Regulatory Commission (FERC) for approval, “given the far-reaching market and asset impacts of the proposal and likely debate over ratepayer impacts.”

In the eyes of renewable energy advocates, FERC has had a mixed record in recent decisions dealing with conflicts between state renewable energy policies and federally regulated energy markets.

Energy storage and renewables integration

NYISO’s annual report also highlighted how it’s seeking to keep up with the state’s accelerating clean energy goals. Last year’s report saw NYISO dealing with the implications of the state’s 50-percent-by-2030 renewables mandate, but this year’s report considers Gov. Andrew Cuomo’s new pledge to hit 100 percent clean energy by 2040. “There is no historical precedent for the ambitious changes on the bulk power system envisioned by policymakers," the report states.

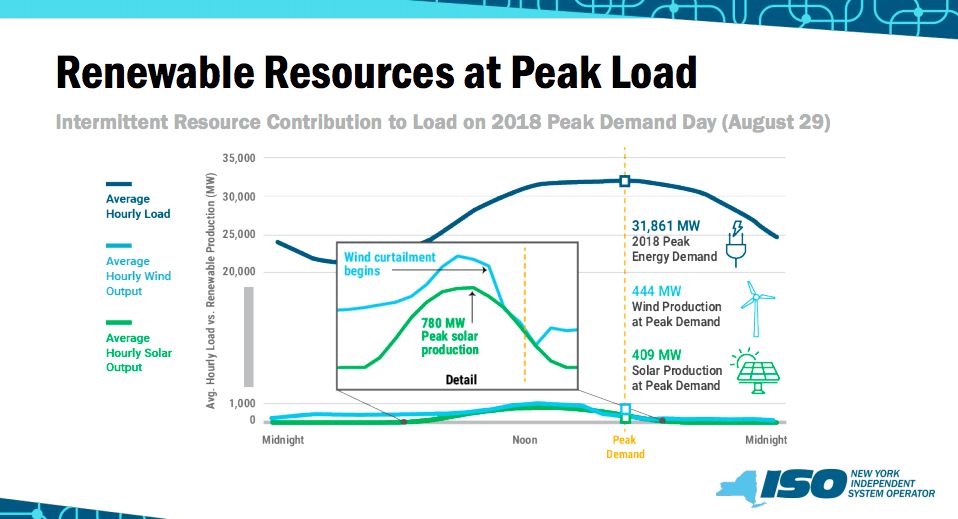

To tackle this list of changes, NYISO plans “further enhancements to its markets to establish stronger price signals for resources, such as energy storage, that are capable of ramping up and down quickly in response to variable output from the growing level of wind and solar resources.”

NYISO’s presentation of the 2018 capacity factors of its clean energy resources illustrates that wind and solar, which make up its fastest-growing resources, also require far more integration with the grid.

On the energy storage front, NYISO, like all other U.S grid operators, is in the midst of implementing FERC Order 841, which requires them to develop tariffs that allow energy storage to participate in their energy markets. (We covered NYISO’s energy storage integration plans in a 2017 GTM Squared article.)

NYISO released its official Order 841 compliance plan last year, but only applied it to wholesale resources such as front-of-meter battery installations, rather than the utility retail programs that would host behind-the-meter batteries. New York’s massive new energy storage plan calls for roughly equal incentives for bulk and retail systems, however, and state agencies including the Public Service Commission and the New York State Energy Research and Development Agency are working with NYISO on ways to bridge this gap.

To serve the emerging distributed energy resource markets being developed under the Reforming the Energy Vision Initiative, NYISO has developed “a comprehensive proposal that would allow DERs to participate in NYISO markets and act as supply based on wholesale prices,” it added. NYISO is looking for more data on all the behind-the-meter DERs like rooftop solar, batteries, plug-in electric vehicles and on-site generators being deployed, which to the grid operator appear as reductions in customer demand, not as the independent energy resources they actually are.

Last year, NYISO picked three pilot projects for this effort, using different technologies — front-of-meter batteries operated by Con Edison and New York Power Authority, a solar-plus-batteries project from Borrego Solar, and a high-rise buildings with curtailable energy loads from Integrated Energy Services.

NYISO’s reliability study of its grid found that it faces no immediate concerns about not being able to meet its peak demands, and that these peaks are set to decline slowly over the next 10 years, along with overall energy usage. That’s driven by a combination of increasingly aggressive energy efficiency efforts, such as New York City’s big buildings carbon benchmark law, as well as the increase in rooftop solar and other DERs that reduce customer load.

While energy storage will continue to add capacity on the wholesale side and reduce demand on the retail side over the next 10 years, electric vehicles are going to become one of the biggest new loads on the grid. According to NYISO’s analysis, EVs could add 410 megawatts to summer demand and 650 megawatts to winter demand by 2030.

In terms of long-range planning, NYISO will spend 2019 doing a study to examine the fuel and energy security for its system over the next five years, which could lead to “recommendations for potential operational, capacity market, and/or energy market mechanisms to drive improvements in grid resilience.”

It’s also in the midst of developing rules to carry out a state order to close about 3,500 megawatts of simple-cycle gas turbines in New York City and Long Island by 2025 to reduce air pollution, a move that, along with the coming closure of the Indian Point nuclear power plant, could affect grid reliability in the region.

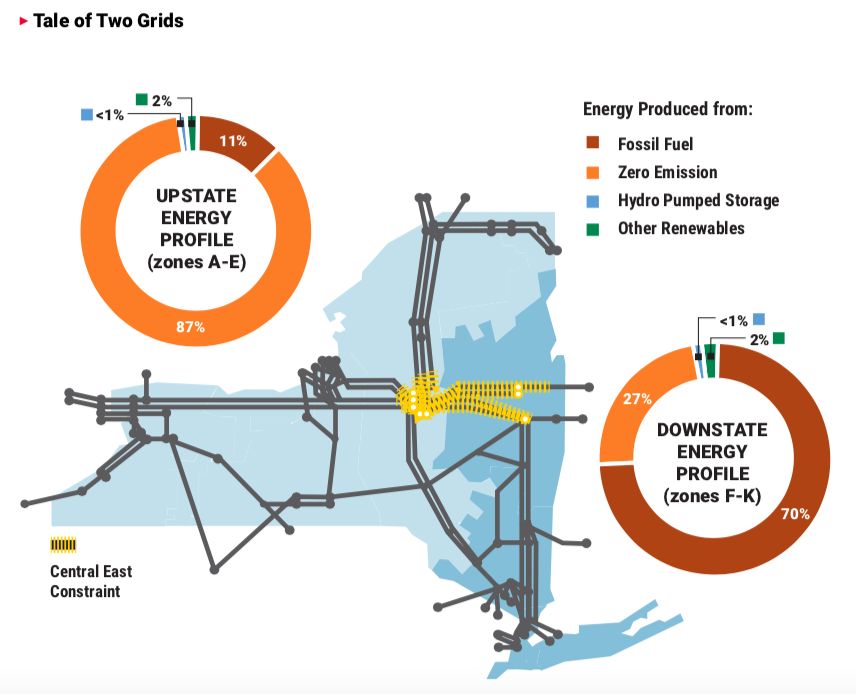

NYISO also reprised its long-running “tale of two grids” presentation, which shows how New York’s upstate region already gets nearly 90 percent of its electricity from clean hydropower and wind resources, while downstate (including New York City) still gets 70 percent of its electricity from fossil fuels. New transmission capacity could help ease this division, and earlier this month, NYISO approved two new big north-to-south transmission projects, the biggest to come to the state in more than 30 years.

Still, those projects take years to permit and build, meaning that New York renewable policies must also play a role in encouraging renewables development downstate, to avoid new upstate projects from pushing out older and thus more expensive, yet still carbon-free, resources already in the region, NYISO noted.