Long Island could become a hot spot for replacing old fossil-fueled power plants with batteries.

The geography of the island constrains access to electricity; it relies on a fleet of aging oil- and gas-fired power plants to meet peak demand. That practice runs up against New York state's crackdown on its dirtiest power plants and its concerted push toward a clean grid by 2040.

But Long Island could start shutting down fossil-fueled peakers and replacing them with batteries in the next few years and save customers money in the process, according to a new analysis from Strategen Consulting and the New York Battery and Energy Storage Technology Consortium (NY-BEST).

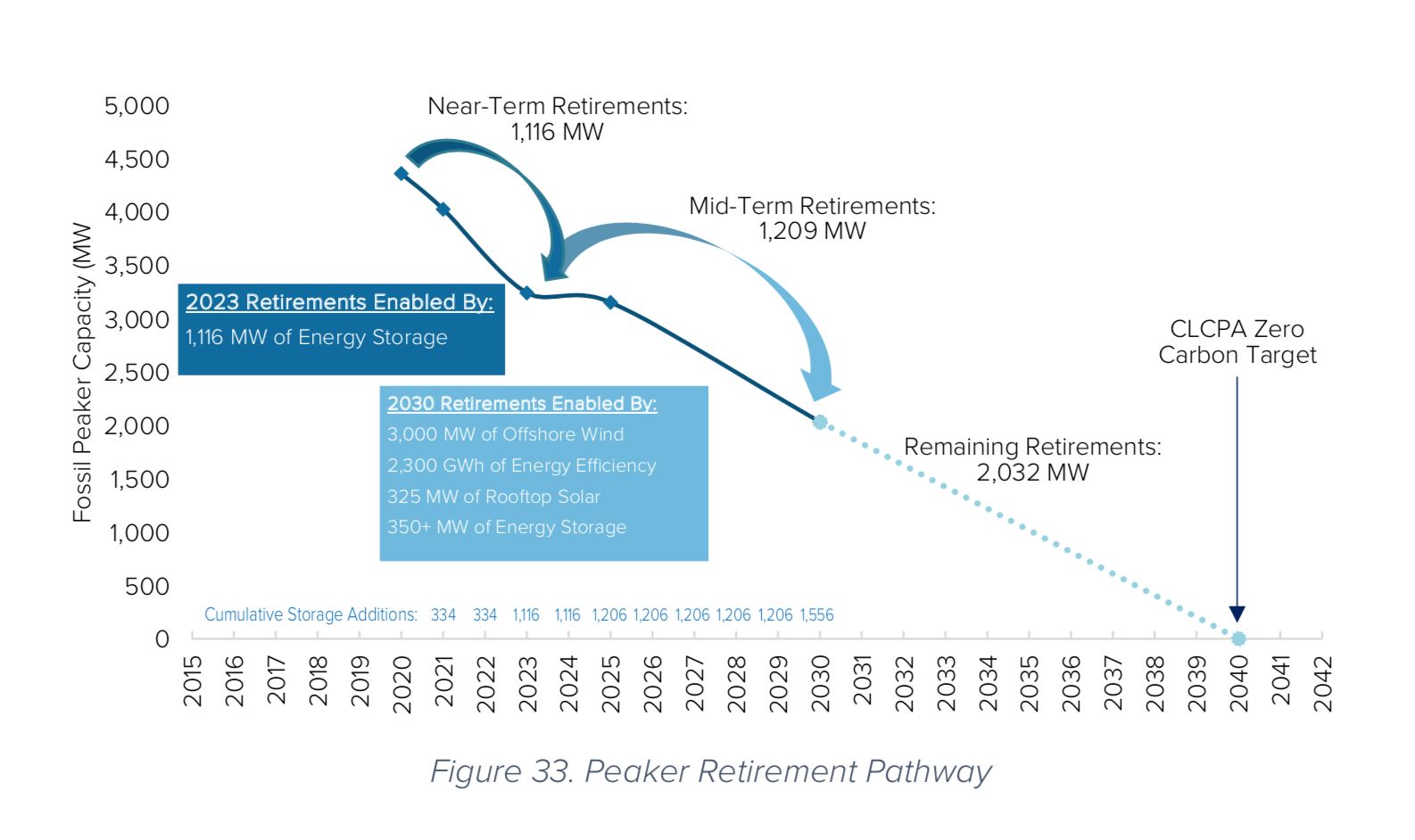

Specifically, the study found that Long Island could get rid of 334 megawatts' worth of peakers today, swap in new battery plants instead, and save money for electricity customers while maintaining reliable power. Another 782 MW could retire by 2023 when new state nitrogen oxide (NOx) regulations kick in. Another tranche totaling more than 1 gigawatt could shut down in 2030, assuming New York fulfills its targets for solar and offshore wind construction by that time.

"The Long Island peakers, they’re old, dirty, and expensive," said Bill Acker, executive director of NY-BEST. "Replacing them will save money and benefit the environment."

This finding reflects the material costs of maintaining an aging fleet that includes plants constructed as far back as the 1940s. On top of that, an environmental rule to reduce NOx emissions from power plants kicks in by 2023, which will force expensive upgrades to several of the plants. Customers will have to pay extra to keep those oil-fired plants around, even though they're rarely needed.

Long Island also has more capacity than it needs, the analysis found. That means customers pay for redundant equipment to sit idle most of the time. Batteries, in contrast, can meet peak needs and perform useful tasks in the power markets outside of peak demand events.

Lithium-ion batteries do have limits on how many hours of energy they can provide. But 54 percent of the peaker starts analyzed in the study lasted four hours or less, well within the parameters of cost-effective battery installations today.

"There’s some low-hanging fruit in some of these peakers that don’t run too often," said lead author Edward Burgess, a senior director at Strategen. Future longer-duration battery technologies could help reduce reliance on the 90 percent of peaker plant starts that last no more than 13 hours.

The peaker retirements and battery installations described in the study would put Long Island on a path toward the state's long-term decarbonization goal. (Image credit: Strategen)

Long Island state of mind

Some of the advantages of storage derive from Long Island's unique regulatory environment, the report noted.

Public power entity Long Island Power Authority oversees the local grid and serves 1.1 million customers with the help of a subsidiary of utility PSEG. Long Island is part of the statewide grid and wholesale markets operated by NYISO, but LIPA gets most of its peaking capacity through a bilateral contract with utility National Grid.

That contract lasts from 2013 to 2028, with some potential offramps. It reflects a long-term commitment to decades-old generators, signed a few years before energy storage became a competitive resource for large-scale capacity.

"Some of these contracts have a pretty high payment for capacity," Burgess said. "Today’s battery prices compare pretty favorably."

Long Island also makes for a natural landing point for New York's planned influx of offshore wind generation, which will play a pivotal role in the state's march toward a carbon-free grid. That means a new supply of generation, which could be stored by batteries for use in later moments of high demand.

"We need to be able to accommodate the vast amounts of offshore wind and other renewables that are going to be coming on," Acker said.

The region also benefits from avoiding the "buyer-side mitigation" rule that the Federal Energy Regulatory Commission has enforced for clean energy assets in New York's capacity market. This rule raises the minimum bid price for batteries in the load pockets of New York City and the lower Hudson Valley. But Long Island, known as Zone K for grid-planning purposes, sits outside those areas.

"These peakers do not face that challenge," Acker noted. "They can participate in the wholesale market without any of the problems associated with the mitigated zones."

Ready to switch?

Long Island has already taken its first steps toward grid battery adoption. LIPA built long-lasting battery systems in East Hampton and Montauk to help meet seasonal tourism demand on the island's eastern tip. And LIPA held a request for information on energy storage earlier this year ahead of a forthcoming request for proposals.

But that process contemplates between 155 MW and 175 MW of storage. "What the study points out is they can increase the scale of those efforts pretty substantially and still be conservative," Acker said.

To be clear, multiple published studies on the efficacy of replacing New York peakers with batteries haven't yet changed the number of actual peaker-to-battery replacements in the state, which still stands at zero.

"We haven’t yet seen replacements," Acker said. "But we’re on the cusp of that."