This is a free preview of GTM Squared. Click here to join Squared and get expert insights like this throughout the year.

* * *

Shayle Kann and the GTM Research analyst team give GTM Squared members insight into our internal discussion and debate on the latest business developments across solar, grid, and energy storage markets in this monthly column.

Shayle Kann Senior Vice President, Research: As you all know, the 30 percent ITC has been extended for three years, with a ramp-down through 2022. We've released forecasts earlier this week that show U.S. solar hitting 20 gigawatts by 2020 and incrementally adding 40 gigawatts over the next five years due to this extension.

But there are tons of details and questions that remain. So, GTM Research team, what are the biggest changes and considerations that come out of the extension within your focused coverage areas?

MJ Shiao Director, Solar Research: From the system cost perspective, this could be a major relief to hardware vendors across the value chain, which were planning for heavy price pressure in 2017. Keep in mind that this doesn't necessarily raise pricing for systems -- demand growth and the opening of new markets is still dependent on cost reductions across the value chain.

Competition will still block out high-price suppliers and new entrants that have cautiously waited will now pour more investment into the U.S., especially as markets like the U.K., Germany and Japan see some setbacks.

What's nice is that developers and companies that have planned for the 2017 pricing environment are now ahead of the game. Cost reduction strategies, such as balance-of-systems integration, 1,500 Vdc, rooftop density maximization, etc., are still every much as applicable in 2017 as 2016. We were expecting to see 8 percent to 12 percent installed cost reductions from 2016 to 2017 under the old regime. Those figures are still possible, but there's less pressure to meet them.

Scott Moskowitz Analyst, Solar Research: As the demand outlook makes clear, this is fantastic news for vendors, installers, and developers alike. However, I don't think we see the pricing pressure truly let up in any market. Many cost reduction innovations -- in particular 1,500-volt systems -- are ready for deployment. These 1,500-volt systems will make up 30 percent of utility projects in the U.S. in 2016 and should contribute to lowering system costs another $0.02 to $0.05/Wp.

Other opportunities such as higher-power inverters with silicon carbide are also well on their way. In my view, the vendor landscape is too competitive for there to be pricing relief. I think the long-term cost curve remains aggressive and simply makes utility PV more competitive.

It does get interesting in distributed solar. SolarCity in particular has been vocal about lowering costs to become cash-flow positive. I don't think it abandons these efforts, but there is obviously a much lesser need to lower costs quickly, particularly in established markets. Enphase has been similarly focused on cost reductions, and I think this takes some of the pressure off. Judging by the 50 percent bump in its stock price the past few days, I'd say investors agree.

Enphase and its competition cannot rest on their laurels, however. The residential inverter market is very competitive. A high-demand future only encourages more competition and new market entrants. Expect to see continued product introductions (still waiting on a DC optimization solution to challenge SolarEdge) and new vendors.

MJ Shiao Director, Solar Research: On Enphase specifically, those cost reductions are must-hit. What's nice about the extension is that it continues to broaden the residential base to new markets and allows for local and regional installers to flourish through direct ownership and loan products. Those end customers appear to make up more than half of Enphase's installations in recent quarters, which means their success is critical for providing the base Enphase needs to be successful.

I'm surprised you didn't mention the boon that extension gives for non-incumbent manufacturers in the utility sector. All those companies that were about to miss the party (e.g., Huawei) or that are still trying to get traction in utility projects (e.g., Sungrow, Yaskawa/Solectria, TMEIC) will see their investments and patience pay off dramatically. I'd hesitate to say that the extension would hurt incumbents -- the market will be big enough for them to continue thriving -- but it does keep a lot of competitors in the game.

Colin Smith Analyst, Solar Research: Developer mindset is going to shift. Developers were in a massive pipeline growth mode and shifting into a massive pipeline completion phase. With 9 gigawatts still to come on-line in 2016, they will not only have to make sure they complete their projects by the contracted commercial operation date, they will now have to shift back into capturing an additional 3 gigawatts of utility PV that is now on the table for 2017. I think we are going to see some dead projects come back with a bit more life and see some early-stage developers selling off more pipeline.

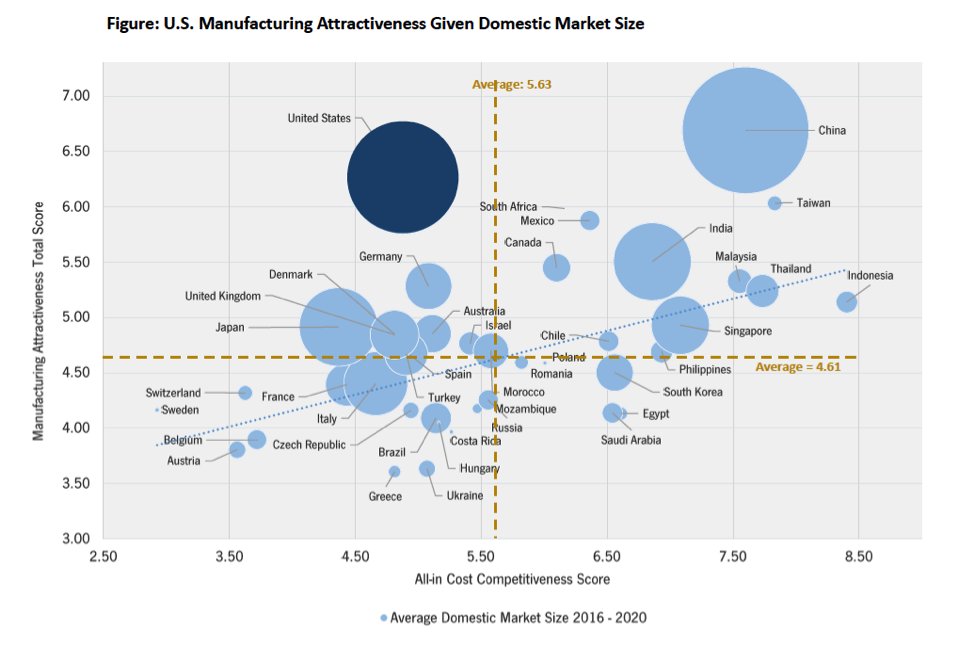

Mohit Anand Senior Analyst, Solar Markets: From a manufacturing perspective, America's attractiveness as a location for PV manufacturing has increased substantially. As tracked in our PVMAX, with the ITC extension, the U.S. is now the second most attractive market for PV manufacturing instead of the fifth most attractive without it.

This is thanks to the sheer size of the increase in domestic demand volume and the stability and growth of its demand trajectory out to 2020. With a business environment and manufacturing ecosystem ranked in the top five out of 50 countries, there is a strong likelihood that the U.S. will see more domestic manufacturing despite its relatively weaker cost-competitiveness compared to the East Asian manufacturing majors.

Source: Global PV Manufacturing Attractiveness Index 2015

MJ Shiao Director, Solar Research: Definitely agree that utility-scale solar is the most affected market. With or without the ITC extension, there's a huge pipeline that needs to be executed on. As Colin implied, nearly 2 gigawatts of projects may slip from 2016 to 2017, but we still expect around 3 gigawatts of utility projects beyond that to come on-line in 2017.

Looks like we're forecasting almost 28 gigawatts of utility solar between 2017-2020. That's over 17 gigawatts more than what our pre-extension forecasts modeled. The ITC doesn't change the fact that many state targets are already fulfilled -- so what are some of the other drivers?

Mohit has an excellent point about manufacturing attractiveness. The extension also buoys the prospects of domestic manufacturers like SolarCity (through Silevo) and SolarWorld. However, extension also means that some of the Chinese module manufacturers may open up more allocation to the U.S.

On the module environment in general, not sure the ITC extension drastically changes the pricing and supply for next year. A revision downward might somewhat soften tight supply at the end of the year, but likely not by much. Many of those projects are just slipping into 2017, so the module agreements are already or will be soon in place anyway.

Under the no-extension scenario, many manufacturers indicated significantly reduced allocations -- not just because of less demand, but because the price-plus-tariff environment meant much smaller margins vs. other global markets. With the ITC extension and potential feed-in tariff revisions in China and Japan, the U.S.' importance for global module manufacturers has increased substantially -- and so has the need for tariff-exempt capacity. Also, that Silevo acquisition by SolarCity is looking better and better, although it's still contingent on execution.

Nicole Litvak Senior Analyst, Solar Research: Of course this impacts utility-scale solar the most, but it also has big implications for distributed generation. The residential solar boom will continue. However, net-metering and rate-design battles remain the biggest challenge for that sector, and I don’t think the extra 6 gigawatts we’ll get from the extension will help the situation.

We’ll also continue to have a level playing field for third-party and customer-owned solar, at least until 2021. This is a big win for the many installers that rely mostly on loans and cash sales, as well as the companies that provide those loans. The extension will also help to open up new state markets. This is an opportunity for both the SolarCity/Vivint/Sunruns to expand and for new local installers to pop up.

And finally, the ITC extension is literally a lifesaver for the non-residential market, which needs all the help it can get. It will remain the smallest market segment, but it’ll be more than 50 percent larger than it would have been otherwise in the period 2016-2020. Financing is still the big challenge, but perhaps a shift to cash/loans in residential solar will help bring more tax equity funds over to non-residential.

Scott Moskowitz Analyst, Solar Research: Is there any other way this might affect the struggling non-residential market, Nicole? Obviously it improves the economics. Does the tax credit extension make it more likely that we'll see new business models or policies (PACE, REITS, MLPS)? Are these still on the table and attractive?

Nicole Litvak Senior Analyst, Solar Research: I think it's actually the opposite (except for PACE, which is and will continue to be a major driver of small commercial). Non-residential needs to focus on plain old tax equity financing, and now it has the opportunity to do that. There are still many challenges to efficiently matching projects with financing. Now the market just has more breathing room to find solutions and take advantage of the 30 percent ITC.

On a related note, I wonder how this will affect the YieldCo market. There will be more assets to fuel YieldCos (across all market segments), but the immediate question is still whether they will fully recover from this year's slump. Anyone else have thoughts on this?

MJ Shiao Director, Solar Research: As far as YieldCos are concerned, the ITC extension doesn't hurt, but I don't know if it pulls them out of the current conundrum. There are broader investor-sentiment and company-specific forces at play, but in general, until their share prices rise, it'll remain difficult for them to raise the cheap capital they need.

Of course we aren't equity analysts, but SolarCity's price has rebounded strongly after the ITC news. YieldCos and their partners have as well, but not to the same level, indicating that there are strong, non-ITC influences at play.

Austin Perea Analyst, Solar Research: Previously our forecasts had residential PV installations growing in 2016 before taking a hit in 2017 due to the ITC expiration, and then rebounding to near-2016 installation levels in 2018.

The revised scenario, whereby the ITC is extended through 2021 with various stepdowns, leaves residential solar in a position for tremendous growth. It should be noted, however, that uptake of distributed generation is also contingent upon how customers are compensated at the meter for exporting power back to the grid.

California also had huge win this month with the CPUC ruling on "NEM 2.0," which more or less keeps export compensation at the retail rate. Given that California represents about half the market for residential, a favorable ruling on NEM 2.0 and an ITC extension is a huge win.

When it comes to markets outside of California, we've seen some very impressive growth coming from a number of nascent markets with an installed base of 10 or more megawatts. Nevada was the leader of this group of fast-growing states in the last quarter, and an ITC extension undoubtedly supports this continued trend of geographic diversification of demand.

However, in-state regulatory proceedings in those states will also be important to the long-term growth of these markets. Both Vermont and Nevada have important NEM 2.0 rulings coming out in the next two months and could define the outlook going forward.

Cory Honeyman Senior Analyst, Solar Markets: Nicole, Austin and Colin hit the nail on the head with their points. A revitalization of origination opportunities for utility-scale solar, a level playing field continued for direct-owned residential solar, and recent major net metering win in California all speak to a broader theme.

The extension of the ITC will accelerate the growth trajectory to new heights in both established and emerging state markets for solar. We're talking an additional 1 million homeowners and businesses that will go solar between now and 2020 thanks to the extension. And as Colin noted, we're in a new phase where dirt-cheap utility-scale PPAs are not a 2016 fluke, but a trend that will keep on emerging.

For utility scale, my money's on the Southeast and Texas being the hottest markets. And to Nicole's question, my new favorites for distributed solar are a handful of markets, some of which Austin mentioned. Vermont is creeping up there now, but by 2020, a few other states to watch are New Mexico, Michigan and Utah. They all have 10 percent year 1 savings and top-tier installers located there, making them ripe for high growth.

Austin also asked about how the ITC extension plays into future NEM debates. More residential solar will come on-line over the next five years (24 gigawatts) than all solar installed to date thanks to the extension. And a number of states are going to have to deal with grid penetration challenges sooner rather than later.

The big question is whether residential solar can grow at record rates and become a true asset to the grid -- and an asset that utilities properly account for in net metering rules. I don't think net metering rules can stay static in a world where solar exceeds 10 percent of states' loads.

Systems and technologies team, what do you think about how smart inverters and other innovations can support residential solar growth in high-penetration markets?

Also, I'll throw out one other question on my mind to Colin Smith. High or low? I think one-third of all centralized solar procured between now and 2020 will come from large corporates.

Colin Smith Senior Analyst, Solar Research: I'd say closer to 20 percent to 25 percent, rather than one-third.

California, Nevada, Arizona and Texas will be big markets for retail procurement, but I also think we are going to see more projects like Amazon's 104-megawatt system in Virginia pop up. We will also see more green tariff deals like the recent one with Duke and Corning.

Several years down the line I think we will see more companies push back to own and receive power directly from these PV projects. But in the meantime, they will go through a green tariff.

Scott Moskowitz Analyst, Solar Research: Our projections obviously show accelerated growth in distributed solar penetration. Utilities will take this seriously and double down on mandating advanced inverter requirements. Rule 21 in California is the main mechanism for this and has laid out the feature sets required for the inverter vendors.

The early requirements -- reactive power and functions that prevent blackouts during voltage drops -- are easily met. However, the communications protocols in the later phases will take a strong effort between the inverter vendors and utilities to standardize. The SunSpec Alliance is taking the lead and will now have a greater incentive to accelerate its work.

Beyond advanced inverters, this becomes a huge opportunity for energy storage. Not only does energy storage ensure its proportional benefit of the ITC going forward, but higher PV penetration rates will only encourage their use as a grid-stabilization and demand-balancing tool. GTM's energy storage research team definitely has their work cut out for them even more than before.

MJ Shiao Director, Solar Research: As Scott mentioned, there are functions that help dampen intermittent solar's effect on the grid, but technology continues to outpace requirements and regulations. What we have through Rule 21, HECO's requirements, and, more broadly, IEEE standards is mostly passive. The next step is to transform these solar devices into usable grid assets to further mitigate the impact of high-penetration PV -- and perhaps make the grid more reliable as a whole.

You're seeing these discussions coming up more in various market transformation processes. Look for other regions to look toward these states for precedent. Also, we had a brief discussion about this topic at our recent U.S. Solar Market Insight conference.

In short, the ITC extension is a game-changer and accelerates the timeline for the next stage of solar. We'll hit nearly 100 gigawatts of cumulative solar by the end of the decade -- after starting the decade with less than 2 gigawatts.

With that ramp up, solar isn't just a promising technology. It's a real, deployable tool and platform for a next-generation electricity grid. The regulations and innovations that come together in the second half of this decade will set the stage for what the future of electricity in the U.S. looks like.

***

Click here to learn more about the latest grid edge research from GTM Research. You can read bios for the analyst team here.