The combination of a pandemic, supply-chain disruptions, economywide lockdowns and a worldwide recession is bad news for virtually every industry, and the electric vehicle sector is no exception. Add a historic decline in oil prices making fossil fuels cheaper at the pump, and 2020 is shaping up to be an especially rough year for the plug-in car market.

Global passenger EV sales declined sharply in response to the COVID-19 pandemic. China, the world’s largest auto market, saw EV sales plunge by 60 percent in February compared to the same month last year. The precipitous drop came on top of softening consumer demand for plug-in cars prior to the pandemic, as the government started to phase out subsidies.

In the U.S., EV sales in April fell by more than 50 percent compared to the same month a year earlier. This follows a down year for EV sales in America in 2019. Congress failed to extend federal tax credits for EVs last year, removing a key incentive for top electric car manufacturers going forward. The Trump administration also rolled back national fuel economy standards during the pandemic, making the regulations easier for companies to meet without selling EVs.

As economies open up and global automakers get back to business, it’s an open question as to how companies and governments will prioritize spending on new EV products and technologies, as well as sales incentives, public awareness campaigns, charging infrastructure and other steps to help make EVs go mainstream. But while plug-in vehicles are expected to be on a bumpy road for the next few years amid the fallout from the coronavirus pandemic, industry experts say they already see light at the end of the tunnel.

Several major auto companies, including Volvo, Volkswagen and General Motors have underscored their committment to vehicle electrification in recent weeks. Ken Morris, GM’s vice president of electric and autonomous vehicles, said on a press call last month that product development work on the company's future EV portfolio "is progressing at a rapid pace" despite the pandemic.

“I think we’re going to find a reluctance on the part of some consumers in the very short term. And I’m talking short term — six months, maybe a year,” Michigan Rep. Debbie Dingell (D-Dearborn) said on the Political Climate podcast distributed by GTM. “Then we need to ensure that the autos have the resources that they need [to bounce back].”

The EV market: How bad will it get, and how fast will it recover?

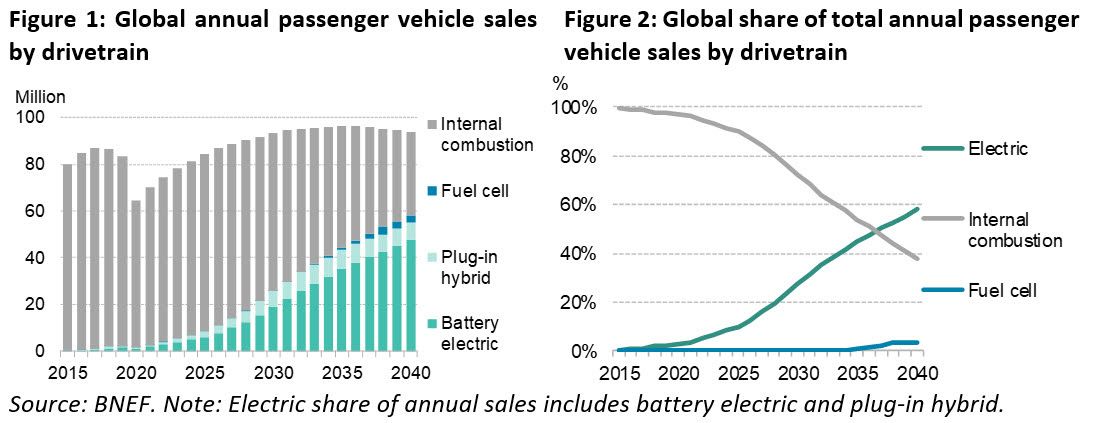

Bloomberg New Energy Finance anticipates global EV sales will fall by 18 percent in 2020 — to 1.7 million sales worldwide — as the overall automotive market contracts. Longer-term, however, BNEF believes EV adoption will continue to accelerate, with electric models accounting for nearly 60 percent of all new passenger car sales worldwide by 2040, representing 31 percent of the entire car fleet in that year.

Wood Mackenzie has a more pessimistic forecast. The research and consulting firm projects that global EV sales will fall by a whopping 43 percent this year — to 1.3 million vehicles by the end of 2020 — driven primarily by manufacturing delays and weak consumer demand. But despite potential delays in EV adoption, principal analyst Ram Chandrasekaran said in a statement that uncertainty caused by the recent oil price war and global catastrophes is likely to strengthen automakers’ resolve to embrace electrification going forward, “not deter it.”

Nick Albanese, head of BNEF’s intelligent mobility team, said the discrepancy between EV market outlooks is a reflection of economic uncertainty amid the COVID-19 recovery. “This is really an unprecedented moment for the global auto market,” Albanese said in an interview.

BNEF expects EV sales to drop this year, but plug-ins still fare better than internal combustion engine vehicles, which are expected to see sales decline by 23 percent in 2020. This base-case analysis assumes the COVID-19 pandemic continues through the second quarter of next year in most major markets. If the pandemic chokes economies for several years, Albanese said, EV sales will decline further, more in line with WoodMac’s analysis.

There’s also the potential for a quicker recovery. In a scenario where the global economy returns to growth by the fourth quarter of this year, BNEF expects EV sales to increase by about 3 percent in 2020. The International Energy Agency’s latest analysis aligns with this more optimistic outlook, concluding that global electric car sales will continue to inch upward this year, beating the 2019 total.

“There are...many upside and downside risks to these expectations,” IEA analysts cautioned. “Ultimately, government responses to the COVID-19 crisis will determine what happens to electric car markets in 2020 and beyond.”

American EV market lags many others

China’s EV market has already started to rebound from the height of the country’s lockdown, with help from a recent extension of government subsidies for certain EV purchases and a steadily increasing mandate for new energy vehicles.

Europe, meanwhile, bucked the downward trend almost entirely, with EV sales up 81 percent year-over-year in the first quarter of 2020 (Norway was the only major market to see a decline). Some of that growth was due to delivery backlogs from the previous year, but several countries, including Germany, Sweden and Greece, continued to see sales increase throughout the pandemic.

The EU’s stringent targets to reduce the carbon-intensity of new vehicle sales by 2030 are one of the biggest drivers of EV sales growth for the continent, said Albanese. France’s new $8.8 billion stimulus plan to reboot its domestic auto sector — which includes increasing the incentive available to purchase an EV to more than $7,000 — is expected to give the European EV market an additional leg up this year.

Germany’s new coronavirus stimulus bill also boosts EV subsidies, nearly doubling the discount for non-luxury vehicles to roughly $10,000. In addition, the country mandated installing EV chargers at all gas stations.

“The EV market absolutely remains a policy-driven one,” said Albanese. “That's the case in all of the major markets today: China, Europe and the United States.”

The difference is that the U.S. market is lagging behind other nations. Despite Tesla’s standout performance in the U.S. market, BNEF anticipates EV sales overall will remain flat in the U.S. for the next few years unless new policies are put in place.

“I don’t think, as a matter of public policy, the United States has really gotten behind electrification and EVs,” James Chen, vice president of public policy at the American EV manufacturer Rivian, said in an interview for Political Climate. “And we need to change that.”

Internal combustion engine "becoming obsolete”

Congresswoman Dingell said last month that her top priority in the “very short term” is getting U.S. auto manufacturers and their suppliers safely back in operation and financially stable. “Then we need to get back to ensuring that we are going to a carbonless society and investing in the technology that's going to get us there,” she said.

“The fact of the matter is, the internal combustion engine is becoming obsolete," Dingell continued. "We need to move to more innovative technologies. We are the nation that developed and gave people the ability to be mobile, to travel around. And I will not cede that to China or India or any country in Europe. We are going to stay at the forefront of innovation and technology, and that's why it's so critical to support it.”

According to BNEF, global sales of internal combustion engine vehicles peaked in 2017 and will continue to decline in the coming years due to the lingering effects of COVID-19 and increasing sales of EVs.

However, plug-in sales don’t begin to ramp up significantly until 2030 and beyond. Variables such as additional battery cost declines, the successful launch of new EV models, bigger investments in charging infrastructure and other actions will be necessary to get sales up to speed.

Rep. Dingell introduced legislation in January that would allocate $2 billion each year to the Department of Energy's Advanced Technology Vehicles Manufacturing Incentive Program. “The USA Electrify Forward Act” also boosts funding for EV charging and directs the Secretary of Transportation to “accelerate domestic manufacturing efforts” related to EV batteries and power electronics.

Dingell and other lawmakers have called for extending the $7,500 EV federal tax credit, which failed to make it through Congress last year.

While Senate Republicans have so far refused to approve additional stimulus spending, Democrats are advancing several plans, including the House Committee on Transportation and Infrastructure’s new INVEST in America Act. The five-year, $494 billion bill introduced earlier this month would invest heavily in EV charging infrastructure and zero-emissions buses.

“Automakers and governments worldwide have spent hundreds of billions of dollars on preparing for the shift away from gasoline to an electrified, digitized future. The country that reaches this goal first stands to reap tremendous economic and strategic benefits for years to come,” Robbie Diamond, president and CEO of Securing America’s Future Energy, a nonpartisan organization committed to reducing U.S. oil dependence, said in response to the new bill.

“If we want a future that relies neither on an unstable oil market nor [on] China...it is vital that we win this race," Diamond said.

Political Climate is produced in partnership with the USC Schwarzenegger Institute. Listen and subscribe on Apple Podcasts, Spotify, Stitcher, Google Play or wherever you get podcasts.