Four years after the Block Island project first put wind turbines in American waters, the second U.S. offshore wind farm is about to rise 30 miles off Virginia Beach, and it’s happening in the middle of a pandemic.

With just two turbines, the Coastal Virginia Offshore Wind pilot is tiny; and with a price tag of $300 million, it’s very expensive for a generation facility of its size. But Dominion sees the 12-megawatt project as a critical stepping-stone to its planned multi-gigawatt offshore wind empire in the Mid-Atlantic region, says Mark Mitchell, the utility’s head of generation projects.

After years of permitting and preparation, the installation of the turbines and their foundations should be finished over the next six weeks or so, Mitchell said in an interview. The project is one of the few in U.S. waters not owned by a European developer.

The major turbine components, all made in Europe, have been waiting in Halifax, Nova Scotia for a specialized installation vessel to sail in. That ship arrived in Canada from Europe on Sunday, Dominion confirms.

The vessel will transport the foundations down to the project site and install them in the “late May, early June timeframe,” Mitchell said. It will then return to Halifax for the pair of Siemens Gamesa turbines, erecting them in the final weeks of June.

Subsea cabling and other work will continue for a few more months. By the end of 2020, Dominion will join Deepwater Wind (now Ørsted) as one of just two developers to drag a U.S. offshore wind project over the finish line — and the first to do so in federal waters.

A tiny project in a market obsessed with scale

One of offshore wind's most important attributes is its scale: skyscraping turbines, horizon-crowding projects and multibillion-dollar price tags that make even infrastructure funds blush.

Since the 30-megawatt Block Island project went up, most U.S. projects have followed Europe’s lead in going very big. Vineyard Wind, which could follow the Virginia pilot as the third U.S. project, will be built in two 400-megawatt installation seasons. Dominion is already working on its own follow-up: a 2.6-gigawatt project to be built in three phases in 2024-2026.

In contrast, the Coastal Virginia pilot is a minnow. And at an estimated $300 million for a 12-megawatt facility — excluding financing costs — the project's price tag has raised eyebrows and drawn concerns, including from the Virginia state regulators that approved it. The cost, including any overruns, will be passed on to Dominion’s ratepayers.

The high cost of Dominion's pilot, both on a per-megawatt-installed and a per-megawatt-hour-generated basis, reflects the project's small size and the immaturity of the U.S. offshore wind market. There is no local supply chain to speak of today, let alone a competitive one.

The turbines were manufactured by Siemens Gamesa in Denmark and the foundations by EEW in Germany. Dominion made several unsuccessful attempts to get competitive bids for the engineering, procurement and construction work, according to a regulatory filing (PDF). Eventually, it awarded the EPC job to two vendors without competing bids: Ørsted is handling offshore construction, and L.E. Myers the onshore work.

Denmark's Ørsted, the world's leading offshore wind developer, is not generally in the business of building projects for other companies, but Dominion's EPC job came with the exclusive right to negotiate a partnership for the 2.6-gigawatt project to come.

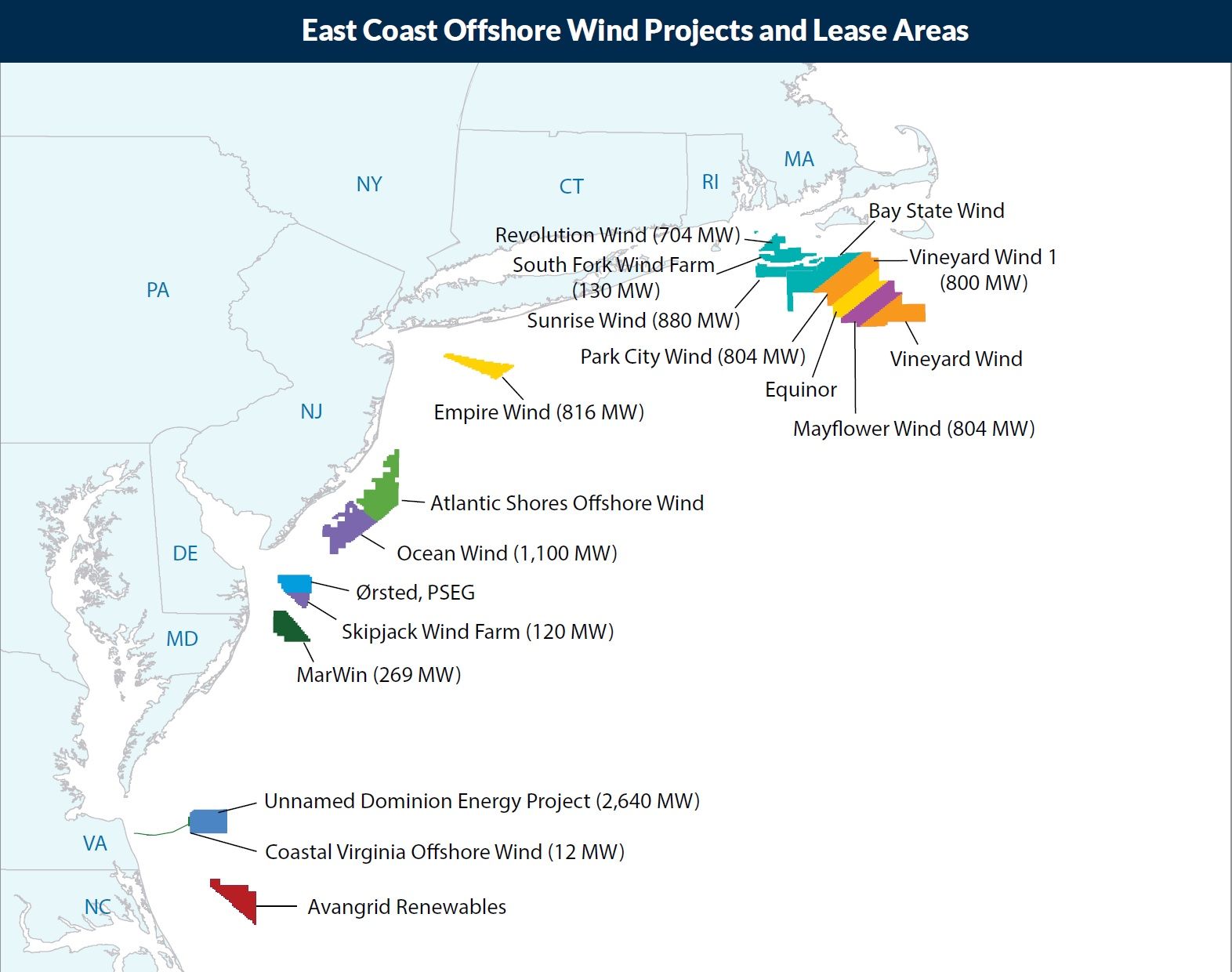

The current state of U.S. offshore wind projects. (Credit: AWEA)

Mitchell argues that the two-turbine demonstration was a prudent step before leaping toward gigawatts worth billions. Dominion knows how to build lots of things, but offshore wind is a new chapter. "I can't just send somebody out to check on a turbine."

The value of the pilot has come on several fronts, Mitchell said. To begin, both the Bureau of Ocean Energy Management (part of the Department of Interior) and Dominion had to learn what it meant to permit an offshore wind farm in federal waters. “We both were setting precedents in a lot of cases." Two dozen gigawatts of offshore wind are set to follow Dominion through BOEM’s process over the next decade. “From start to finish, we’ve had a front-row seat as the first one to do it."

Meanwhile, the pilot's location adjacent to Dominion's larger project site means much of the permitting and subsea survey work done so far will be useful for the bigger wind farm to come. And when the pilot's two turbines are up and spinning later this year, they will offer real-world production data that Dominion can use to plan its future projects.

Even before the first turbine goes up, “we’ve already learned a tremendous amount about offshore wind," Mitchell said.

The first U.S. offshore wind installation vessel

The Coastal Virginia pilot will also get wheels spinning in the local supply chain in a way that could pay dividends when it comes to Dominion's bigger project.

Dominion is counting on an increasingly localized supply chain to help drive down costs at future projects, and the utility believes Virginia could emerge as a major offshore wind manufacturing and logistics hub, Mitchell said. Virginia’s recently passed Clean Economy Act, which requires more than 5 gigawatts of offshore wind by the mid-2030s, strengthened the case for that future.

If the installation vessel’s back-and-forth pathway between Nova Scotia and Virginia sounds extremely circuitous, that’s because it is. The 100-year-old Jones Act requires that goods shuffled between American ports only be carried by U.S.-flagged vessels. But there are no offshore wind installation vessels waving American flags today, leaving Dominion to park its components in Canada during the construction process.

Dominion's turbines en route to Canada to await installation. (Photo: Dominion)

In a big step for the market, Dominion recently confirmed plans to join a consortium of investors that will build the first U.S. offshore wind installation vessel, expected to be in service in 2023.

Such a vessel, likely to cost several hundred million dollars, is an unusual investment for an American power utility. In addition to Dominion’s own wind farms, the vessel will contract with other projects. CFO James Chapman told investors earlier this month that Dominion expects to make “infrastructure-style returns” from its stake.

After studying the European market, Dominion determined that having such a vessel to call upon was the "lowest-risk, least-cost" option as it prepares for its multi-gigawatt build-out, Mitchell said.

A Siemens Gamesa factory in Virginia?

Siemens Gamesa, based in Spain, made waves earlier this year when an executive said the company was “actively considering” building a factory in Virginia’s Hampton Roads region.

A Siemens Gamesa spokesperson told GTM the company is looking at ways to support local offshore wind content in "various states," adding that "blades have been the primary focus of our investigations in Virginia." The company has not made any final decisions about "whether or where certain elements of the supply chain might be located," the spokesperson wrote in an email this week.

Siemens Gamesa, which will supply turbines for Dominion's 2.6-gigawatt project in addition to the pilot, this week launched a new 14-megawatt offshore turbine model, the world's largest.

Mitchell says the stars are aligning for production facilities in Virginia. The state already has a significant workforce engaged in the maritime economy in the Norfolk/Hampton Roads area, where the Navy has a large presence. Compared to New England and other states to the north, Virginia has lots of potential space for offshore wind factories and none of the overhead restrictions — like bridges — seen in states like New York.

“Virginia started with a fairly good advantage. Then we came along with what’s currently the largest offshore wind project in the U.S.," Mitchell said. "I think the combination of a good workforce, the physical attributes of the port and a large anchor project sitting there really makes [Virginia] attractive as an offshore wind hub."

The subsea foundations, which can weigh thousands of pounds, are expensive to transport over long distances and make a good candidate for local production, Mitchell said.

A gap of several years will separate the Coastal Virginia pilot and the much larger project to come, but that doesn't translate into a lull for Dominion's growing offshore wind team. Work on the larger project has been ramping up for a year or so, since before it was made public, Mitchell said. Dominion intends to file its Construction and Operations Plan, a key permitting document, later this year.

Dominion, one of the country's largest utility groups, recently announced a plan to build 24 gigawatts of new renewables over the next 15 years, including enough offshore wind to meet Virginia's target on its own. The generation profile of offshore wind, with strong production at night and in winter, matches well with Dominion's already-large base of solar plants, Mitchell said.

Four years is not a lot of time to plan, permit and build the first phase of a multi-gigawatt offshore wind farm, especially in the nascent U.S. market. "Every day is critical for that commercial project," he said.