The coronavirus pandemic has thrown a wrench into U.S. microgrid development and may delay project origination and timelines over the next year, according to Wood Mackenzie’s latest review and forecast.

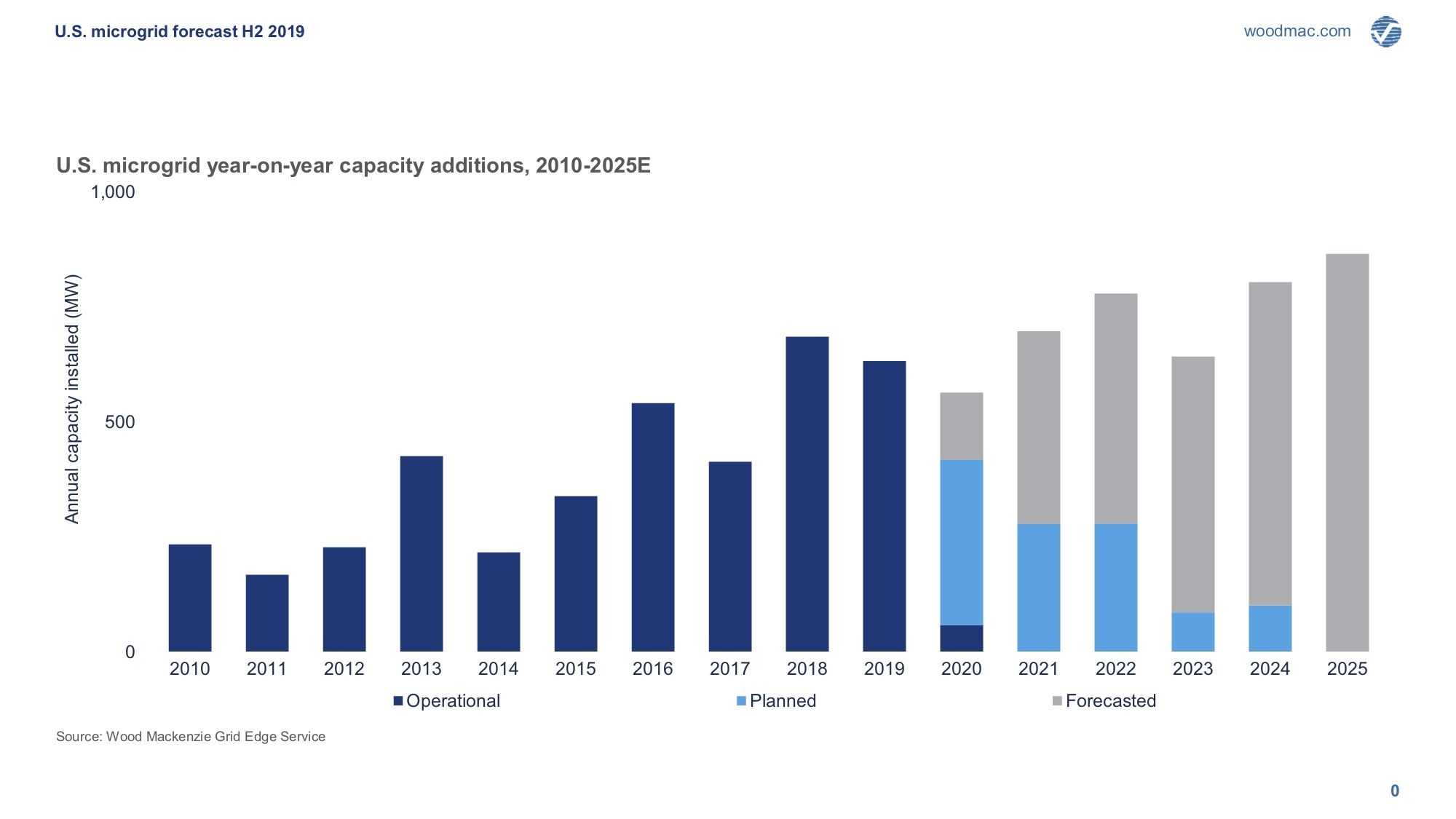

The first half of 2020 was the slowest for the U.S. microgrid market since 2016, with only 58 megawatts of projects on the books, according to WoodMac’s survey of projects of at least 100 kilowatts in size. That’s a steep drop from the 291 megawatts of projects installed in the first half of 2019.

The slowdown is driven by shelter-in-place and stay-at-home orders that have forced microgrid projects to delay permitting, construction and interconnection processes amid the country’s COVID-19 pandemic, microgrid analyst Isaac Maze-Rothstein wrote.

That’s similar to the delays that have hurt U.S. distributed solar and energy storage deployments, which rely far more on being able to access buildings and work with local authorities to complete their work than do utility-scale projects

Meanwhile, “some developers have expressed concerns around originating new deals as some customers wait to see how the pandemic and recession impact their core business,” Maze-Rothstein wrote.

Financial uncertainty is expected to combine with ongoing delays in developing projects and lags in equipment supply chains to reduce the U.S. microgrid outlook through 2022. Larger-scale projects greater than 50 megawatts could see project development timelines extended by a year, while smaller-scale projects can expect an average delay of three months.

These disruptions will begin to ease in late 2021 as the pandemic comes under control and project developers and customers seek to take advantage of expiring federal tax credits for solar PV systems that are becoming more prevalent in microgrid projects.

All told, the pandemic will play a significant part in slowing down a market that’s otherwise seeing growing demand from customers and critical facilities seeking resiliency against grid outages caused by wildfires, storms and other extreme weather events.

The market is led by commercial customers such as hospitals, factories and cold-storage facilities that are particularly vulnerable to extended blackouts such as those imposed in Northern California during fire-prevention blackouts, or those caused by hurricanes across the Southeast U.S. and Eastern Seaboard.

Third-party financing from modular microgrid providers such as Southern Company’s PowerSecure, Texas-based Enchanted Rock, Massachusetts-based Tecogen and California-based Bloom Energy, and financing options from more complex, larger-scale microgrid developers including Engie and Schneider Electric, are likely to gain increased interest from this class of customers in the face of coronavirus impacts and the resulting economic recession, Maze-Rothstein said.

These commercial systems rely on fossil-fueled generation or combined-heat-and-power systems, which are still more cost-effective for long-term power supplies than clean alternatives such as solar and batteries. But solar power and batteries are expected to take an increasing share of the market in years to come, largely as part of broader systems built around natural-gas-powered generation.