In late July, Consolidated Edison held its first ever demand response auction -- aiming to shed more than 20 megawatts of load in a few specific outer-borough neighborhoods of New York City.

The results were a success for both auction winners and the utility. The auction is also a harbinger of a new way of doing business that is likely to spread far beyond Con Edison’s near-term timeline and even beyond the utility itself. At the very least, other New York utilities may look at Con Edison's program to inform their own non-wires alternatives, which are being mandated by the state's Reforming the Energy Vision proceeding.

“This program sets an important precedent for looking at non-wires alternatives in a big way," said Marina Hod, manager of demand response operations at Direct Energy, one of the auction winners. “Hopefully the success of the BQDM program will open the door to more innovative ways to monetize demand flexibility and distributed resources.”

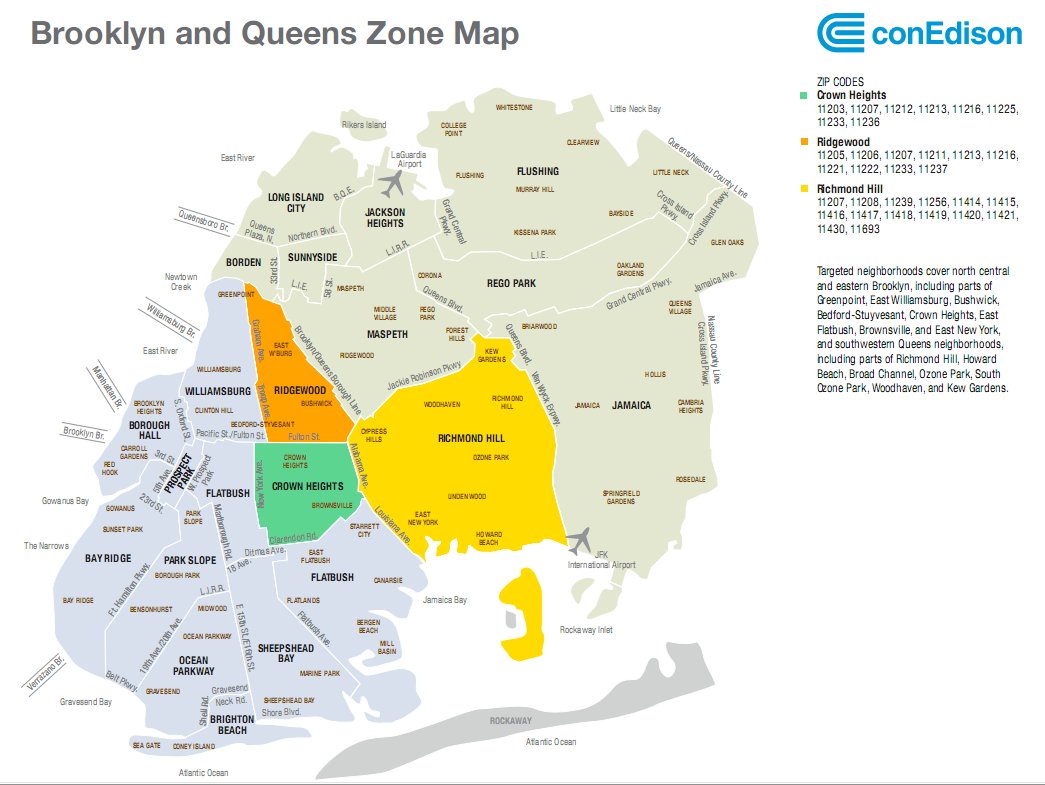

The auction was part of Con Edison’s Brooklyn Queens Demand Management project, an ambitious yet highly targeted program announced in 2014 with the aim to defer about 52 megawatts of load on certain circuits in Brooklyn and Queens, in order to delay the cost of constructing a $1.2 billion substation. This project came before the state regulators were demanding utilities look at demand-side resources, although Con Edison is now considering more non-wires alternatives. The program has already shed about 9 megawatts through energy-efficiency upgrades in more than 7,500 apartments and more than 4,000 small businesses.

BQDM is the largest modern non-wires alternative program in the nation, leveraging everything from more efficient LEDs to combined heat and power to utility-scale and behind-the-meter batteries. It will also leverage some traditional grid upgrades, such as new capacitor banks and substation upgrades.

Crafting the auction

Con Edison knew that it had one shot to get the auction right, as it held the auction for the coming summers of 2017 and 2018 on back-to-back days in late July. The utility held various webinars, events and training sessions for potential participants, and most said they felt comfortable with the technology and auction rules going in.

There were two time frames for each year, 4 p.m. to 8 p.m., and 8 p.m. to 12 a.m. Con Edison’s peak is about 9 p.m. to 10 p.m. in that area, but it has pockets of peak from noon until midnight that have to be addressed to delay the substation build-out.

For that reason, the prices in the later time slot were much higher, and therefore attracted more bidders. It was a reverse auction that began with ceiling prices that participants then bid downward on.

For 2017, the prices for the two time zones had ceilings of $250 per kilowatt-year and $1,250 per kilowatt-year. In 2018, the ceilings were $750 per kilowatt-year and $1,250 per kilowatt-year.

The clearing prices for the evening period in both years were similar, about $985 per kilowatt-year, according to Con Edison, while 2017 saw $215 kilowatt-year for the earlier time slot, and in 2018, the earlier time period will pay $450 per kilowatt-year. For a winner that pledges 100 kilowatts for the later timeframe in 2017, for example, the company would be paid $98,500 if it delivered that capacity for the entire season.

There is also a separate payment of $5 per kilowatt-hour of reduction for each event. Participants that offer 100 percent of pledged load can also earn up to a 20 percent bonus on the reservation payment. Those that offer less than 85 percent of pledged load will face a penalty.

There were 10 winners out of more than a dozen participants, most of which pledged load for both years. The companies were a mix of behind-the-meter battery startups and established demand response players that included Green Charge Networks, Stem, Digital Energy Corp., EnerNOC, Innoventive Power, Direct Energy, Power Efficiency Corporation, Demand Energy, Energy Spectrum and Tarsier.

“Overall, we were very satisfied,” said Raghusimha Sudhakara, manager of BQDM for Con Edison.

At nearly $1,000 per kilowatt-year, the later timeframe was attractive to all participants, and especially behind-the-meter battery aggregators. Three-quarters of the load is in the evening time slot. Most companies interviewed are participating in both years, although many were only participating in the more lucrative 8 p.m. to 12 a.m. timeframe. For nearly all participants, it will be the first time working in these neighborhoods and securing load that late at night.

That creates both an opportunity and a challenge. These neighborhoods are a world away from Manhattan’s skyscrapers and Class A office space. These are mostly small and medium-sized apartment buildings or commercial sites, and few have central AC.

Stem had already identified corporate chains that it works with in California that also have facilities in the BQDM area that it could potentially work with. Karen Butterfield, chief commercial officer at Stem, said there were “easily” a dozen enterprise customers the company has in California with locations within the BQDM area. Stem has committed 857 kilowatts for the evening period for the two years, most of which will be delivered in 2018.

Similarly, EnerNOC and Direct Energy have a deep understanding of which customers can provide demand response for a four-hour time frame, and will be targeting those commercial customers, which could include grocery stores, cold storage and other warehouses.

EnerNOC already works in New York, although not this particular area, while Direct Energy said it already has some commercial and industrial customers it can tap in the neighborhoods. Behind-the-meter provider Green Charge Networks is another aggregator that already has some exposure in New York, working with companies such as Walgreens and UPS.

“We’ll spread the net wide,” said Steve Doremus, a senior manager at EnerNOC, another auction winner. EnerNOC would not disclose how many megawatts it bid, nor would Direct Energy, but it could be a significant amount, as many smaller players likely bid in relatively modest kilowatt blocks to test their technology over the four-hour periods.

Another player that is already in New York but not working within BQDM territory is Demand Energy. It is currently installing lead-acid battery system at multiple locations in New York, but for BQDM, it will be deploying outdoor lithium-ion battery installations at a mix of commercial and multi-family buildings. The startup also has plans to integrate some of its energy storage with solar to store the solar energy and use it during the evening when it has committed capacity.

The decision for outdoor battery systems is meant to make it easier to get through the installation process and receive approval from the New York City Fire Department, which is wary of indoor lithium-ion batteries because of the risk of fire. “FDNY is starting to get comfortable with lithium in outdoor locations,” said Doug Staker, VP of global sales of Demand Energy. But indoor lithium-ion can take many months to get approval, although FDNY, NYSERDA, Con Edison and others have been working to standardize and streamline the process.

Other companies are looking at BQDM as a chance to test their mettle for the first time in New York. Tarsier is a startup that purchased an energy management system from Demansys that is used by Alcoa in upstate New York to bid its smelters into the state’s wholesale demand response market.

But Tarsier is taking an entirely different approach downstate. The startup will use either alkaline or bromine batteries to meet its 250-kilowatt commitment during the evening hours. "It’s a test for us,” said Isaac Sutton, CEO of Tarsier. “We haven’t decided on the size of the systems.”

A new kind of customer for a new kind of auction

For participants that are expecting to tap large hotels or hospitals, they’ll find pickings are relatively slim in these outer-borough neighborhoods. Many of the national brands that are ubiquitous in midtown Manhattan or across California are nonexistent in neighborhoods like East New York, Ozone Park and Richmond Hill.

For Green Charge, however, its relationship with Walgreens could translate into an opportunity with subsidiary Duane Reade, a drugstore chain with locations across New York City. Green Charge has committed about 1 megawatt for 2017 and 2 megawatts for 2018.

“This is outside our core C&I base,” acknowledged EnerNOC’s Doremus, speaking in terms of customer mix. He added that it was a welcome challenge for EnerNOC to think outside the box. For traditional aggregators like EnerNOC and newcomers alike, it will make them approach smaller commercial customers and the relatively underserved multi-family market differently.

But with enough money on the table, the BQDM winners are embracing the challenge of finding new participants to commit resources. “This is the trend we’re seeing across a lot of different markets,” said Doremus. “Utilities and grid operators are trying to find ways to just be more flexible, whether that’s more granular dispatch or bigger availability windows. A program like this is going to be a model for other utilities going forward, so we’re glad to participate and want to be at the forefront of this.”

***

To learn more about Con Edison’s BQDM and other non-wires alternatives in New York, join New York REV Future 2016. This year’s conference will bring together key stakeholders, technology providers, utilities and state policymakers to discuss actionable business strategies to operationalize the ongoing initiative for a clean, resilient and affordable system in New York. Register today and join the conversation.