Arizona Public Service, the state's largest utility, has released its plan for reaching zero-carbon by 2050, including several options to balance the costs and benefits of switching from coal and natural gas to renewables, batteries, distributed energy resources and as-yet-untested technologies.

In the nearer term, APS is aiming to hit 45 percent renewable electricity by 2030, with its Palo Verde nuclear power plant bringing the tally up to 65 percent carbon-free power. The utility's massive integrated resource plan (IRP), filed with state regulators this week, would achieve those levels without building any new gas plants. Instead, APS wants to invest heavily in utility-scale solar and energy storage, along with customer-owned distributed energy and load flexibility.

While APS wants to eliminate all of its coal-fired power by 2031, it plans to keep natural-gas-fired power plants running through at least 2035 to maintain reliability for a region with sky-high summertime temperatures and energy demand.

Just how much of that gas can be cost-effectively replaced with renewables and energy storage will depend on changing battery costs, as well as the potential for new technologies such as hydrogen generated by clean energy to replace it, Brian Cole, general manager of resource management, acquisition and planning for the 1.3-million-customer utility, said in a Tuesday interview.

“We have to use a reasonable amount of natural gas as a bridge fuel to keep costs down,” Cole said. The IRP offers “a flexible approach, especially in the medium term, to let technologies emerge [and] let costs decline so we continue moving toward that goal.”

Short term: Lots of renewables, no new natural gas

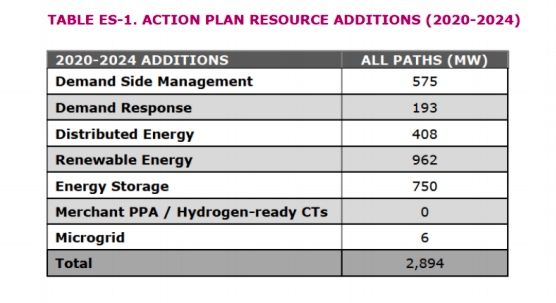

APS’ short-term plans remain the same no matter which long-term portfolio it and regulators choose.

Through 2024, APS plans to add 962 megawatts of renewable energy to its current 1,700 megawatts, as well as 850 megawatts of energy storage. Beyond existing requests for proposals for 150 megawatts of solar-plus-storage, 150 megawatts of “battery-ready” solar PV and 250 megawatts of wind power, APS plans to announce an all-source procurement for energy and capacity later this year.

“We have needs to increase renewable energy, and we also need to add on capacity to serve our customers,” Cole said. The upcoming RFP will ask for “any type of resource that can meet any one of those criteria.” Most likely the capacity will come in the form of batteries. The IRP calls for an additional 1,750 megawatts of energy storage by 2030 to “provide the backbone of replacement capacity and energy” as it exits coal-fired power completely by 2031.

On the distributed energy front, APS expects about 400 megawatts of customer-owned rooftop solar to come onto its system by mid-decade and is seeking another 200 megawatts of demand response and 575 megawatts of demand-side management such as smart thermostats, water heaters and distributed batteries. These customer-sited resources can shift consumption away from peak hours in the late afternoon and early evening to reduce capacity needs, and capture low- or negative-priced midday solar energy from within its borders and from neighboring California to lower the costs of that shift.

APS is going big on renewables and batteries in the near term. (Credit: APS)

The IRP calls for no new gas plants in the next four years, a sharp turnaround from a previous plan that called for up to 5,000 megawatts of gas-fired capacity. In 2018 the Arizona Corporation Commission declined to acknowledge the gas-heavy IRPs from APS and Tucson Electric Power Co. and put a temporary freeze on new gas plant construction, forcing both to resubmit plans relying on clean energy.

That puts pressure on APS to secure an additional 6,000 megawatts of capacity over the next decade. Utility's load continues to grow even as it retires more than 1,400 megawatts of coal-fired power and faces the expiration of about 1,600 megawatts of medium-term purchases from existing merchant natural-gas plants.

At the same time, the falling price of utility-scale solar and energy storage has altered cost-benefit equations for natural gas. That’s evident in shifts in long-range plans from utilities across the country, including Tucson Electric Power, which last week submitted an IRP heavy on new wind, solar and energy storage, and PacifiCorp, which is seeking gigawatts of new renewables and batteries for its six-state Pacific Northwest and Rocky Mountain territory.

Long-range tradeoffs: Carbon reduction vs. costs

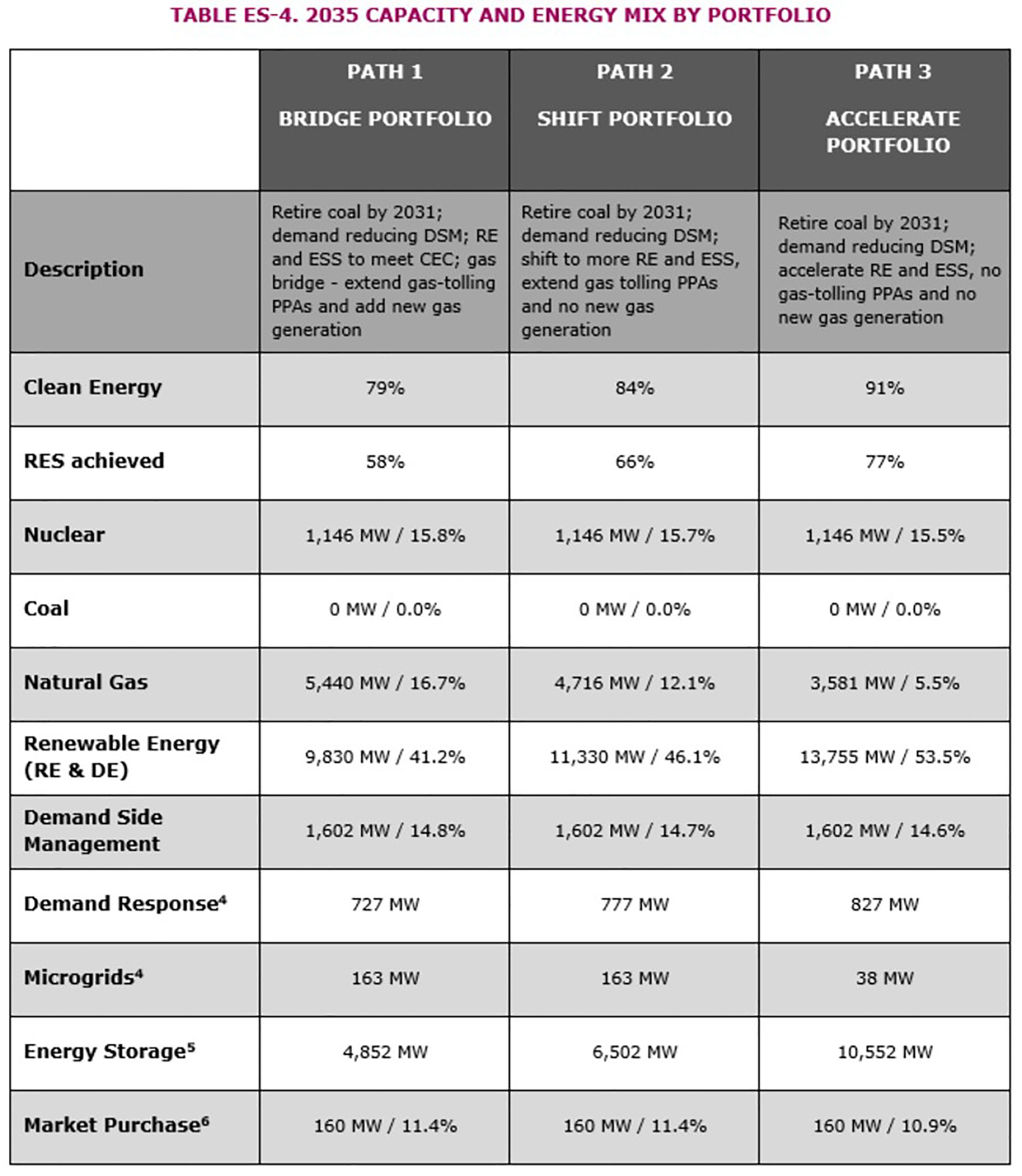

Hitting its zero-carbon goal over the longer term will require hard decisions about how deeply and quickly to reduce its reliance on natural gas, as the IRP's three portfolios through 2035 make clear.

- The “Bridge” portfolio would add new gas generation to reach 5,440 megawatts, or 16.7 percent of generation, while increasing renewable energy to 9,830 megawatts, or 41.2 percent of generation, along with 4,832 megawatts of energy storage, to reach 79 percent clean energy.

- The “Shift” portfolio would add no new plants but retain merchant natural-gas power supplies for 4,716 megawatts, or 12.1 percent, and increase renewables to 11,330 megawatts or 46.1 percent, along with 6,502 megawatts of storage, to reach 84 percent clean energy.

- The “Accelerate” portfolio would end its merchant natural gas contracts and rely solely on its own plants, for 3,851 megawatts or 5.1 percent of generation, and increase renewables to 13,755 megawatts, or 53.5 percent of generation, combined with 10,522 megawatts of storage to reach 91 percent clean energy.

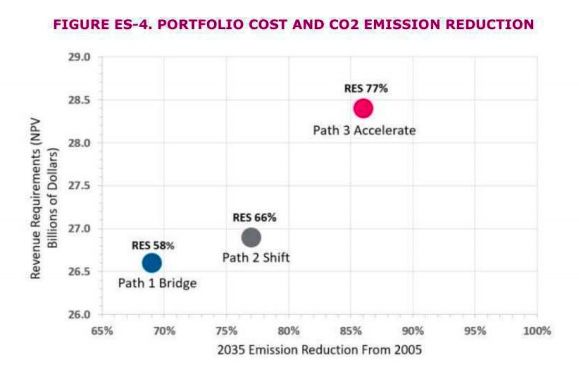

The three portfolios differ significantly in terms of total carbon reduction impact — and their potential costs. While the Accelerate portfolio will reduce carbon emissions more than the Shift and Bridge plans, APS estimates it will also cost several billion dollars more, as this chart indicates.

On the other hand, building new natural-gas plants under the Bridge scenario could end up costing customers more as falling renewable and battery costs leave gas plants as stranded assets, as groups including the Rocky Mountain Institute and the Sierra Club’s Beyond Carbon campaign have argued.

The path APS takes will depend not only on costs for batteries and other longer-duration storage technologies but also on the viability of hydrogen as a replacement for natural gas, Cole said. APS is working with Idaho National Laboratory to research the viability of generating hydrogen from nuclear power generated during off-peak hours, one of many efforts around the world to examine how hydrogen generated from carbon-free energy could supplant fossil fuels.